Documentation related to importing transactions into the InsCipher portal (Updated on 10/16/2023)

Table Of Contents

- Introduction

- POST Import Request VS GET Import Response

- Authentication and URL

- JSON Request Sample

- Field Descriptions and Requirements

- Additional Fields for Data Migration

- Mapping Fees and Tax Titles

- How Do Generic Lines of Business Import Codes Work?

- Can I Import Documents In A Separate Step?

- Immediate Response Format

- Get Import Results API Call - Optional

- How Do I View And Correct Batch Import Errors?

- Version History

Introduction

InsCipher has an API Endpoint available for your agency to programmatically import transactional policy data and documents into InsCipher’s online portal. In most cases, in order to take advantage of this API, you will need your IT team to be able to extract policy data and documents out of your policy management system, map the fields, and then submit the data electronically through our API endpoint in a JSON format. Most of our clients that have set this up, import batches daily into InsCipher. All batches imported, will be logged and tracked in InsCipher with a batch import ID number. This number also gets associated with individual transactions. InsCipher does have the ability to make certain required fields optional, depending on your workflow. If you have questions on this process or want to get set up, please contact support@inscipher.com.

TIP: There are different methods or approaches to importing transactions using this REST API. If you need a quick solution to test out an import and do not currently have one, consider utilizing Postman.

POST Import Request Vs GET Import Response

The transaction import for V4.0 differs from previous import versions in that it allows for a much greater volume of transactions to be imported into InsCipher at one time. The import is designed to be completed in two steps:

Step 1: POST JSON batch file to the Import Endpoint

Run the POST request to import specific transactional details formatted with specific header names to start the import process. This detail can also include a link to documents related to the transactions. Details on submitting an import request can be found here.

Step 2: Send a GET request to get a detailed Import Response

Run a request to GET the details on whether or not a specific transaction was imported successfully or if there were any import errors. Details on getting an import response can be found here.

Authentication and URL

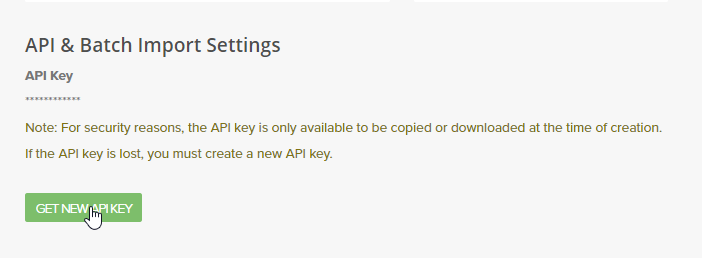

A user is authenticated using an API key, which is provided by your InsCipher implementation specialist. The API key is typically around 40 characters.

API Key: XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX

Note: Your API Key can be reset at any time by the primary Filing Agency Admin logging into the InsCipher Connect portal. After logging in, go to "My Profile" by first clicking the arrow next to the user name in the top right corner. Afterward, click the button to “GET NEW API KEY”.

HTTP Method:

POST

There are two options for passing through your API key:

- Include API key in the header (recommended)

- Include API key in the URL

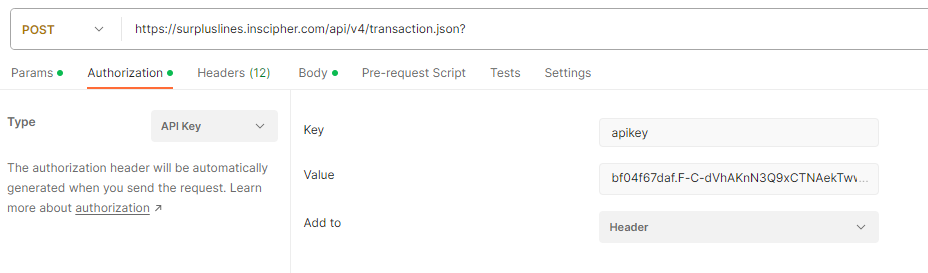

Method 1: URL Endpoint (API key in Header):

https://surpluslines.inscipher.com/api/v4/transaction.json?

If you are using the header method (default for new users), ensure that the API key is included in the header.

Example:

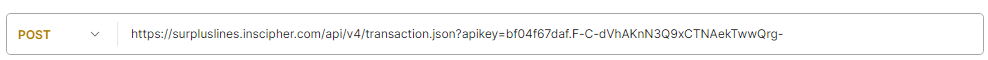

Method 2: URL Endpoint (API Key in URL):

https://surpluslines.inscipher.com/api/v4/transaction.json?apikey=xxxxxxxxxxxxxxxxxxxxxxx

Example:

JSON Request Sample

Descriptions of each field are listed below

[{

"id": "201702028950",

"policy_number": "CA20170228-05",

"policy_effective_date": "2017-02-01",

"policy_expiration_date": "2018-02-01",

"transaction_effective_date": "2017-02-01",

"expiring_policy_number": "CA20170228-04",

"invoice_date": "2017-02-01",

"invoice_number" : "INVN-10001",

"transaction_type": "PN",

"policy_type": "standard",

"account_written_as": "B",

"rpg": 1,

"layered_risk": 1,

"broker_of_record": 1,

"risk_retention_group": 1,

"purchasing_group_name": "Cal Association",

"risk_description": "General Accidental Coverage",

"ecp": 0,

"exempt": 0,

"multi_state": 0,

"policy_limit": 0.00,

"property_limit": 0.00,

"transaction_line_of_business_list": "GEN-1001|GEN-1002|GEN-1003",

"transaction_line_of_business_coverage": "950.75|2000.25|157.50",

"non_admitted_insurer_code_list": "39381|AA-1120841|12833",

"non_admitted_insurer_code_coverage": "50|30|20",

"syndicate_list": "AA-1120131|AA-1120124",

"syndicate_list_coverage": "60|40",

"premium": 3108.50,

"agency_fee": 200.00,

"inspection_fee": 0.00,

"collection_fee": 0.00,

"sl_tax": 117.00,

"stamping_fee": 7.80,

"sl_service_charge": 0.00,

"municipal_fee": 0.00,

"fm_tax": 0.00,

"empa_tax": 0.00,

"total": 4224.80,

"commission_received": 0,

"mailing_insured_name": "Westfield Galleria at Roseville",

"mailing_address": "1151 Galleria Blvd",

"mailing_city": "Roseville",

"mailing_zip_code": "95678",

"mailing_state_code": "CA",

"insured_entity": "individual",

"insured_email": "producer@demo.none",

"insured_phone": "212-456-7890",

"insured_county": "Washington",

"physical_same_as_mailing": 1,

"stamping_fee_invoice_id" : "INVST-20001",

"sl_tax_invoice_id" : "INVSL-30001",

"agent_id" : "",

"agent_notes" : "test notes",

"business_group_id" : "Division 1",

"customer_code" : "OPT CUST CODE12",

"retail_producer_name": "Producer Name",

"retail_producer_license": "12654",

"retail_agency_name": "Producer Agency Name",

"retail_agency_license": "15456F",

"retail_address": "Demo street 1",

"retail_address2": "2nd floor",

"retail_city": "Demo City",

"retail_state": "WA",

"retail_zip": "12345",

"retail_phone_number": "801-888-8488",

"retail_email_address": "bob@gmail.com",

"associated_producer" "123456",

"sop_name": "SOP Name",

"sop_address": "Demo street 1",

"sop_address_2": "2nd floor",

"sop_city": "Winthrop",

"sop_state": "WA",

"sop_zip": "98862",

"dc_naic": "54267|37816|49865",

"dc_date_declined": "2017-02-02|2017-02-03|2017-02-04",

"dc_declining_reason": "wrong|bad|incorrect",

"dc_representative_name": "John|Doe|Johnson",

"dc_representative_title": "Mr|Dr|Ms",

"dc_representative_email": "demo@demo.none|test@demo.none|demo@demo.none",

"dc_representative_phone_number": "54|36|465",

"dc_representative_website": "demo.none|demo.none|demo.none",

"dc_who_received_the_declinations": 3,

"dc_other_person_in_office": "Some Other Person",

"dc_who_performed_diligent_search": 1,

"wind_storm_eligible_for_pool": 1,

"wind_storm_primary_amount": 10,

"wind_storm_other_coverages_deductible": 25,

"wind_storm_exclusion": 1,

"wind_storm_deductible": 0.51,

"lloyds_cover_holder_number": "",

"lloyds_cover_holder_name": "",

"transaction_documents": [{

"code": "D1DISC",

"transaction_documents": [{

"code": "D1DISC",

"url": "https://www.google.com/logos/doodles/2017/abdul-sattar-edhis-89th-birthday-5757526734798848-

res.png",

"id": 1000001

},{

"code": "POLIC",

"url": "https://www.google.com/logos/doodles/2017/abdul-sattar-edhis-89th-birthday-5757526734798848-

res.png",

"id": 100000

}]

}]

Do you want to import documents separately? Click here for instructions.

Field Descriptions

|

Field Title (header must be exact on JSON) |

Description |

Field type |

Required |

||||||||

|

id |

A unique ID used for tracking imported transactions This number will be used to identify possible duplicate transactions. Identified duplicate transactions will be excluded from being imported. |

varchar (255) |

|

||||||||

|

policy_number |

Policy number. Non-unique field. |

varchar (50) |

✓ |

||||||||

|

policy_effective_date |

Policy effective date |

date (yyyy-mm-dd) |

✓ |

||||||||

|

policy_expiration_date |

Policy expiration date |

date (yyyy-mm-dd) |

✓ |

||||||||

|

transaction_effective_date |

Transaction effective date For endorsements, this is the endorsement date. For New/Renewal policies, this is equal to the policy effective date. If omitted, today's date is used as transaction eff. date |

date (yyyy-mm-dd) |

✓ |

||||||||

|

expiring_policy_number |

Expiring Policy Number Only Required for Renewal type policies. |

varchar (50) |

Depends |

||||||||

|

invoice_date |

This is the date that the policy was invoiced in most states. In GA, this is the Revenue Recognition Date, in HI, this is the Date Issued. If omitted, the filing effective date will be used. |

date (yyyy-mm-dd) |

Depends |

||||||||

|

invoice_number |

This is the invoice number (or unique transaction ID) generated by your Agency Management System (AMS). This number allows users to trace imports to existing transactions within the management system as is a value we recommend importing. This number will be used to identify possible duplicate transactions. Identified duplicate transactions will be excluded from being imported. |

varchar |

|

||||||||

|

transaction_type |

Updated transaction types can be found here. |

varchar (50) |

✓ |

||||||||

|

policy_type |

Options include "standard", "master", or "cert" If unknown, choose "standard" or leave blank |

varchar (50) |

|

||||||||

|

account_written_as |

Use one of these two options: Brokerage = B Direct Client = DC Use "B" if you sell through a retail agent. Use "DC" if the policy is sold directly to the insured. If omitted, the default Agency Admin setting will be used |

varchar (50) |

|

||||||||

|

rpg |

Risk Purchasing Group? Yes = 1 |

tinyint(1) |

✓ |

||||||||

|

layered_risk |

Layered Risk Yes = 1 No = 0 |

tinyint(1) |

|

||||||||

|

broker_of_record |

Broker of Record Change Yes = 1 No = 0 |

tinyint(1) |

|

||||||||

|

risk_retention_group |

Risk Retention Group Yes = 1 No = 0 |

tinyint(1) |

|

||||||||

|

purchasing_group_name |

Required if RPG (rpg field) is set to Yes (or 1). If not included and RPG = Yes, then the transaction will still import but will show RPG error. |

varchar(255 ) |

Depends |

||||||||

|

risk_description |

Description of Risk For New York, Ohio, and Pennsylvania, we require specific import codes to be used when importing. For all other states, import this as a text value description of the coverage. See this table for a list of the state-specific codes. To download the table, hover over the top right corner of the table, click on the three dots, and then export to CSV. |

varchar(255 ) |

Depends |

||||||||

|

ecp |

Exempt Commercial Purchaser? No = 0 If omitted, 0 (zero) value will be imported. Unless you know what this is, set this value to 0. |

tinyint(1) |

|

||||||||

|

exempt |

Is the Insured/Entity considered tax-exempt by the state? Exempt Yes = 1 Unless you know that the insured/Entity is Tax Exempt, set the value to 0 or leave it blank (the system will default to 0). Currently Required only for the state of Utah. |

tinyint(1) |

|

||||||||

|

multi_state |

Does the insured’s liability reside in multiple states? Multi state Yes = 1 InsCipher does not calculate Multi-state surplus lines tax breakdowns. With NIMA dissolving in 2016, InsCipher reports 100% of the premium to the home state of the insured and bases the tax percentages off that state. If omitted, the default is No (0). There are only a few states where InsCipher has enabled this field. Note: Only these states allow multi-state FL, CA, ID, WV, KY |

tinyint(1) |

|

||||||||

|

policy_limit |

This is the aggregate policy limit/liability amount associated with the policy. The requirement depends on State and Agency settings. There are about a dozen states that require this information when filing. For this reason, we recommend that you include the policy limit on every submission. If it isn't required by the state then this amount will be ignored. However, for a specific list, go here. In PA, this is Casualty Limit only. |

integer(12) |

Depends |

||||||||

|

property_limit |

Property Policy Limit The requirement depends on State and Agency settings. We recommend that you include the property policy limit on every submission. If it isn't required by the state then this amount will be ignored. Currently, this field only applies to PA.

|

integer(12) |

Depends |

||||||||

|

transaction_line_of_business

OR for multiple lines of business use:

transaction_line_of_business_list |

This is an InsCipher-specific import code. We recommend using the Generic Import codes, which can be found here: Generic Line of Business / Coverage Code List If you want to use state-specific codes, you can. These can be found here. For policies with a single LOB, enter the single import code. If there are multiple LOBs, then these would be added and separated by the pipe symbol “|”. The requirement depends on whether the state requires a line of business breakdown. As this varies by state, we recommend importing all transactions with multiple lines of businesses, where applicable. If the state only allows for a single LOB when reporting, our system would select the coverage that is associated with the greatest premium amount $. |

string |

✓ |

||||||||

|

transaction_line_of_business_coverage |

The premium breakout (rounded to the nearest cent) without the dollar sign in the string. Broken-out premiums should be separated by a pipe symbol “|” and should be in the same order as the transaction_line_of_buisness_list. Whether there is a single line of business or multiple, the premium total should always equal the total added in the premium field above. |

string |

✓ |

||||||||

|

non_admitted_insurer_code OR for multiple insurance companies use: non_admitted_insurer_code_list |

This is the NAIC code associated with the insurer. Refer to the Insurance Company import list which can be downloaded here. For policies with multiple insurance companies, provide the NAIC insurer code list. Multiple values are separated by the pipe symbol “|”. For Lloyd's policies, use “AA-1122000”. Also, review syndicate_list and syndicate_list_coverage. This requirement depends on the state requiring an insurance company breakdown. As this varies by state, we recommend importing all transactions with multiple insurance companies, where applicable. Example: 26883|35351 Must also provide details in non_admitted_insurer_code_coverage “non_admitted_insurer_code_list": "26883|35351",

|

string |

✓ |

||||||||

|

non_admitted_insurer_code_coverage |

Applicable percentage breakdown. For single insurance companies, list "100" here. For multiple insurance companies, list the breakout. This value would be the percentage breakdown in 100 based values (without the “%” sign). List these in the same order as the non_admitted_insurer_code_list. Multiple values are separated by the pipe symbol “|”. The requirement depends on if the state requires an insurance company breakdown. As this varies by state, we recommend importing all transactions with multiple insurance companies, where applicable. If a state doesn't allow for multiple to be reported, then our system would select the carrier with the greatest percentage and report the amount with that carrier. Example: 60|40 |

string |

✓ |

||||||||

|

syndicate_list |

Syndicate list breakdown for Lloyd's ONLY policies, for mult-carrier policies that have Lloyd's and non-Lloyd's carriers, please refer to the note below. Multiple syndicate codes should be separated by the pipe symbol “|”. The requirement depends on agency settings and if the state requires a syndicate list breakdown when filing. To simplify the import process, we recommend that you import all Lloyd's policies with a syndicate list breakdown (if possible). If the state does not require it, the breakdown will be ignored. Example: "non_admitted_insurer_code": "AA-1122000", "syndicate_list": "AA-1120131|AA-1120124", "syndicate_list_coverage": "60|40" Syndicate lists are required for multiple states. A full list can be found here: NOTE: Should you have Lloyd's and Non-Lloyd's carriers, then import transactions with multiple insurance company breakouts where the syndicates would be included in this breakout rather than as a separate syndicate field. |

string |

Depends |

||||||||

|

syndicate_list_coverage |

Syndicate list breakdown percentages listed as a whole number without the percentage sign "%". Multiple values are separated by pipe the symbol “|”. Keep the percentages in the same order as the list above. The total amount for the array must equal up to 100. |

string |

Depends |

||||||||

|

premium |

Policy premium If omitted 0 (zero) amount will be imported |

decimal(12, 2) |

|

||||||||

|

agency_fee |

Policy / Broker / Agency Fee or other revenue-generating fee charged and retained by the brokerage to cover admin costs. If omitted 0 (zero) amount will be imported |

decimal(12, 2) |

|

||||||||

|

inspection_fee |

Inspection / Audit / Underwriting Fee or fee retained or required to be charged by the carrier. If omitted 0 (zero) amount will be imported |

decimal(12, 2) |

|

||||||||

|

collection_fee |

Collection Fee, which is a fee charged to the insured for the collection of the invoiced amount. Only applicable for KY. This is a non-taxable fee. If omitted or left null, this will import as "0" (zero). |

decimal(12, 2) |

|

||||||||

|

sl_tax |

Surplus Lines Tax (name may vary slightly by state). The requirement depends on the Agency account setting if tax import is optional. If left null, 0 (zero) amount will be imported. |

decimal(12, 2) |

|

||||||||

|

stamping_fee |

Stamping Fee (name may vary slightly as FSLO fee in Florida). The requirement depends on the Agency account setting if tax import is optional. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

decimal(12, 2) |

|

||||||||

|

sl_service_charge |

Currently active only in the states of OR and MS. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

decimal(12, 2) |

|

||||||||

|

municipal_fee |

Currently active only in KY. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

decimal(12, 2) |

|

||||||||

|

fm_tax |

Fire Marshal Tax based on Line of Business. Active in IL, OR, MT, and SD and is based on premium amount. The requirement depends on the Agency account setting if tax import is optional. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

decimal(12, 2) |

|

||||||||

|

empa_tax |

EMPA tax is active in the state of FL and is based on Line of Business. This value is also used (field is renamed on the UI) as the CT Healthy Home Assessment for property type coverages in CT. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

decimal(12, 2) |

|

||||||||

|

total |

We recommend leaving this as null total amount = premium + all taxes + all policy fees. If omitted, the system will sum up and import the total automatically. |

decimal(12, 2) |

|

||||||||

|

commission_received |

Is commission received? Currently only applies to NH. Yes = 1 If the commission is received, policy fees cannot be charged. If omitted, a 0 (zero) value will be imported. |

tinyint(1) |

|

||||||||

|

mailing_insured_name |

Full insured name as it appears in policy documents |

varchar(100 ) |

✓ |

||||||||

|

mailing_address |

Insured mailing address |

varchar(255 ) |

✓ |

||||||||

|

mailing_address2 |

Insured mailing address line 2 (if applicable) |

varchar(255 ) |

|

||||||||

|

mailing_city |

Insured mailing city |

varchar(100 ) |

✓ |

||||||||

|

mailing_zip_code |

Insured mailing zip code |

varchar(20) |

✓ |

||||||||

|

mailing_state_code |

Insured mailing state. 2 letter state code abbreviation. Example: "CA" = California or "FL" = Florida |

varchar(20) |

✓ |

||||||||

|

insured_email |

Email address for the insured |

varchar(100) |

Depends |

||||||||

|

insured_phone |

Phone Number for the insured |

varchar(100) |

Depends |

||||||||

|

insured_county |

Mailing County |

varchar(100) |

Depends |

||||||||

|

insured_entity |

Insured entity types are used for states that may consider certain entity types tax exempt. If omitted, "commercial" will be used. Insured Entity Types are listed below:

Currently only applies to SC, NC, TN, FL & TX. If known, this can be imported for every state and InsCipher will ignore the value in the states where it isn't applicable. |

varchar(100 ) |

Depends |

||||||||

|

physical_same_as_mailing |

If the Physical Address is the same as the Mailing State, then set this value = 1 If the Physical Address is NOT the same as the Mailing State, set this value = 0. IMPORTANT: If you make the physical state the same as the mailing state then you will need to make sure that both addresses are added with valid "States" codes or you will receive an import error. |

tinyint(1) |

✓ |

||||||||

|

physical_address |

Physical address Required if Physical State is NOT the same as Mailing State. |

varchar(255 ) |

Depends |

||||||||

|

physical_address2 |

Physical address line 2 |

varchar(255 ) |

Depends |

||||||||

|

physical_city |

Physical City Required if Physical State is NOT the same as Mailing State. |

varchar(100 ) |

Depends |

||||||||

|

physical_zip_code |

Physical zip code Required if Physical State is NOT the same as Mailing State. |

varchar(20) |

Depends |

||||||||

|

physical_state_code |

Physical state. 2 letter state code Required if Physical State is NOT the same as Mailing State. |

varchar(20) |

Depends |

||||||||

|

retail_producer_name |

Retail Producer Name (ie: John Smith) Required for filing in DE, OR, MS, MO, WA, and CA if the business is written through a Retail Agent/Producer. |

varchar(255) |

Depends |

||||||||

|

retail_producer_license |

Retail Producer License Number Required for filing in DE, OR, MS, MO, WA, and CA if the business is written through a Retail Agent/Producer. |

varchar(255) |

Depends |

||||||||

|

retail_agency_name |

Retail Agency Name (ie: Smith Insurance Agency) Required for filing in DE, OR, MS, MO, WA, and CA if the business is written through a Retail Agent/Producer. |

varchar(255) |

Depends |

||||||||

|

retail_agency_license |

Retail Agency License Number

|

varchar(255) |

Depends |

||||||||

|

retail_address |

Retail Producer’s Address Line 1 Required in DE, OR, MS, MO, WA, and CA if the business is written through a Retail Agent/Producer. |

varchar(255 ) |

Depends |

||||||||

|

retail_address2 |

Retail Producer’s Address Line 2 Required in DE, OR, MS, and WA if the business is written through a Retail Agent/Producer. |

varchar(255 ) |

Depends |

||||||||

|

retail_city |

Retail Producer City Location Required in DE, OR, MS, and WA if the business is written through a Retail Agent/Producer. |

varchar(100 ) |

Depends |

||||||||

|

retail_state |

Retail Producer State Location Required in DE, OR, MS, and WA if the business is written through a Retail Agent/Producer. |

varchar(20) |

Depends |

||||||||

|

retail_zip |

Retail Producer Zip Code Location Required in DE, OR, MS, and WA if the business is written through a Retail Agent/Producer. |

varchar(20) |

Depends |

||||||||

|

retail_phone_number |

For future development |

varchar(255) |

Depends |

||||||||

|

retail_email_address |

For future development |

varchar(255) |

Depends |

||||||||

|

associated_producer |

License number of the associated producer, should this differ from the surplus lines license. Associated producer is meant to be used when the agency license is being used to file but the state asks for a particular broker within that agency to be listed. It is different than retail producer. For instance, in CA, associated producer is the “transactor” for the policy. Only applicable in PA, CA |

varchar(255) |

Depends |

||||||||

|

business_group_id |

Business Group ID This is if you have divisions, regions, or other business groups that you want to assign to a transaction for tracking. This value, if imported, can be found on the Tracking tab in the filing details page of a Filing Agent/Filing Agency Admin User. Most clients choose to leave this field blank |

varchar (50) |

|

||||||||

|

customer_code |

Customer Code This is if you have specific customer classifications in your management system that you want to be associated with a transaction for tracking. This value, if imported, can be found on the Tracking tab in the filing details page of a Filing Agent/Filing Agency Admin User. Most clients choose to leave this field blank |

varchar (50) |

|

||||||||

|

sop_name |

Service Of Process Name Currently, applies to AL and OK. Service of Process (aka service of suit) is a clause used in the event of a failure to pay amounts claimed under the policy, insurers agree to submit to any court of competent jurisdiction in the US to accept summonses and complaints. If asked for in the portal, including the Service of Process information that is included in the policy documents. |

varchar(100 ) |

Depends |

||||||||

|

sop_address |

Service Of Process Address Currently, applies to AL and OK. |

varchar(255) |

Depends |

||||||||

|

sop_address_2 |

Service Of Process Address 2(if applicable) Currently, applies to AL and OK. |

varchar(255) |

Depends |

||||||||

|

sop_city |

Service Of Process City Currently, applies to AL and OK. |

varchar(100) |

Depends |

||||||||

|

sop_state |

Service Of Process State. 2 letter state code Currently, applies to AL and OK. |

varchar(20) |

Depends |

||||||||

|

sop_zip |

Service Of Process Zip Code Currently, applies to AL and OK. |

varchar(20) |

Depends |

||||||||

|

dc_naic |

Declining Carrier NAIC Code Declining Carrier is an admitted insurance carrier that has declined the request for coverage. Multiple values are separated by pipe symbol “|”. Currently available in SC, TN, IN, NY, and CA; necessary for SL-2 creation when batch filing. Here is a mapping sheet that describes all of the declining carrier fields. |

varchar(255) |

Depends |

||||||||

|

dc_date_declined |

Declining Carrier Date Declined Currently available in CA and NY; necessary for SL-2 creation when batch filing Multiple values are separated by pipe symbol “|” and is required if there are multiple NAIC codes. If you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

date (yyyy-mm-dd) |

|

||||||||

|

dc_declining_reason |

Declining Carrier Declining Reason Currently available in CA; necessary for SL-2 creation when batch filing Multiple values are separated by pipe symbol “|” and is required if there are multiple NAIC codes. The value imported would be the reason why the admitted carrier declined to write the business. This value imported is a state-specific reason and should be one of the options provided. If you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

varchar(255) |

|

||||||||

|

dc_representative_name |

Declining Carrier Representative Name Currently available in CA; necessary for SL-2 creation when batch filing |

varchar(255) |

|

||||||||

|

dc_representative_title |

Declining Carrier Representative Title Currently available in CA; necessary for SL-2 creation when batch filing |

varchar(255) |

|

||||||||

|

dc_representative_email |

Declining Carrier Representative Email Currently available in CA; necessary for SL-2 creation when batch filing |

varchar(255) |

|

||||||||

|

dc_representative_phone_number |

Declining Carrier representative Phone Number Currently available in CA; necessary for SL-2 creation when batch filing |

varchar(255) |

|

||||||||

|

dc_representative_website |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form allows for the use of a website instead of a representative name and contact information for completion of the SL2. |

varchar(255) |

|

||||||||

|

dc_who_received_the_declinations |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form (for CA only) This answer pulls in to Question 1 on the SL2 and allows for either the Surplus Lines Broker or the Retail Producer information to be used.

|

varchar(255) |

|

||||||||

|

dc_other_person_in_office |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form (for CA only) This determines if the Surplus Lines Broker, Retail Producer, or someone else in their respective offices actually received the declinations, to correctly answer Question 7 on the SL2 |

varchar(255) |

|

||||||||

|

dc_who_performed_diligent_search |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form Accepted values are as follows:

If Account Written as = Direct Client (DC), then this value will be defaulted to "1" Surplus Lines Broker. |

varchar(255) |

|

||||||||

|

agent_id |

Agent ID or Agency ID Each Agency and Agent user is assigned an “Agent ID”. This value associates the transaction to a specific agency group or user. It is required so that InsCipher knows which agency to associate with the transaction. To get this ID, you will need to log into the InsCipher Connect portal, go to Setup > User List and Settings > and view the Agency ID in the table for your Agency Admin user accounts. |

integer |

✓ |

||||||||

|

agent_notes |

Agent Notes Populates the Agent Notes section on the Filing Details page of a Filing Agent/Filing Agency Admin user. Include only if you want to add other information about the policy not captured in any of the other fields. |

varchar (255) |

|

||||||||

|

umr_number |

Lloyd's transaction number Required in NJ and MS if Lloyd's is a carrier on the policy. |

varchar(20) |

Depends |

||||||||

|

sla_transaction_number |

NJ Transaction Number (Format XXXXX-XX-XXXXX) Required in NJ |

Numeric (12) XXXXX-XX-XXXXX |

Depends |

||||||||

|

wind_storm_exclusion |

Windstorm Exclusion Flag Flag on whether or not windstorm exclusion applies. Only applied to certain property coverages and only applies in TX and FL. TRUE = 1 |

tinyint(1) |

Depends |

||||||||

|

wind_storm_eligible_for_pool |

Eligible For Windstorm Pool? Only applied to certain property coverages and only applies in FL. TRUE = 1 |

Boolean |

Depends |

||||||||

|

wind_storm_deduction |

Windstorm/Hurricane Deductible Amount of windstorm/hurricane deductible related to certain property coverages. Only applies in FL. If not applicable, leave blank. |

decimal(12, 2) |

Depends |

||||||||

|

wind_storm_primary_amount |

Windstorm Primary Amount (Coverage A) Amount related to certain property coverages. Only applies in FL. If not applicable, leave blank. |

decimal(12, 2) |

Depends |

||||||||

|

wind_storm_other_coverages_deductible |

All Other Perils Deductible Amount related to all other deductibles not mentioned in the other fields above. Only applies in FL. If not applicable, leave blank. |

decimal(12, 2) |

Depends |

||||||||

|

lloyds_cover_holder_number |

According to LLoyd's, Cover Holder is a company or partnership authorized by a Managing Agent to enter into a contract or contracts of insurance to be underwritten by the members of a syndicate managed by it in accordance with the terms of a Binding Authority. For additional details please see here |

varchar (255 ) |

|

||||||||

|

lloyds_cover_holder_name |

According to LLoyd's, Cover Holder is a company or partnership authorized by a Managing Agent to enter into a contract or contracts of insurance to be underwritten by the members of a syndicate managed by it in accordance with the terms of a Binding Authority. For additional details please see here |

varchar (255 ) |

|

||||||||

|

transaction_documents |

Section for uploading transactional documents (Policies, Diligent Effort forms, etc.) during API submission. If omitted, documents will need to be added separately using the document import API. Or they can be added manually to the filing details page for each policy. |

(see below) |

Depends |

||||||||

|

└ code |

Document import code examples can be viewed here. |

varchar |

|

||||||||

|

└ url |

Full document URL that can be accessed by our system and downloaded. For security reasons, many of our clients use a temporary URL (expiring after 120 mins) with a one-time use token. |

varchar (255 ) |

|

||||||||

|

└ id |

The unique document ID number. This is optional and used for import tracking purposes only. |

integer(11) |

|

Additional Fields Applicable For Initial Data Migration

We recommend bringing in the current year's transactional data in order for the system to be able to account for what filings have been filed to date. To assist in this process, we have added the following fields to make the data imported contain the correct filing and paid dates.

|

Field Title (header must be exact on JSON) |

Description |

Field type |

Optional |

Required |

||||||||

|

stamping_fee_invoice_id |

varchar |

✓ |

|

|||||||||

|

stamping_fee_date_paid |

Stamping Fee Paid Date If applicable, this value, if imported, designates the data that a filing stamping fee was paid to the state. Note: this value cannot be forced for Utah/Idaho transactions.Stamping Fee Invoice ID If applicable, this value, if imported, relates to any state's stamping fee invoice number. Most clients choose to leave this blank during the data migration process. Note: this value cannot be forced for Utah/Idaho transactions. |

date (yyyy-mm-dd) |

✓ |

|

||||||||

|

sl_tax_invoice_id |

SL Tax Invoice ID If applicable, this value, if imported, relates to any state's SL Tax invoice number. Most clients choose to leave this blank during the data migration process. Note: this value cannot be forced for Utah/Idaho transactions. |

varchar |

✓ |

|

||||||||

| sl_tax_paid_date |

SL Tax Paid Date If applicable, this value, if imported, designates the data that a filing's SL Tax was paid to the state. Note: this value cannot be forced for Utah/Idaho transactions. |

date (yyyy-mm-dd) | ✓ | |||||||||

| other_taxes_paid_date |

Other Fee Paid Date If applicable, this value can be used as a catch-all to track the date that any other state tax or fee was paid to the state. |

date (yyyy-mm-dd) | ✓ | |||||||||

| unique_id |

Unique ID This value is often reserved for certain state-specific ID codes, such as MO's Risk Number, IL's countersignature number, or NY's affidavit number. Import this value during your initial data migration for reference. |

varchar (50) | ✓ | |||||||||

| transaction_status |

Transaction Status Value can be a number below representing the corresponding transaction status.

Note: this value cannot be forced for Utah/Idaho transactions. |

Integer (2) | ✓ | |||||||||

| date_filed |

Date Filed If applicable, the date that the policy was filed with the state. If the Date Filed is added, the system will auto-default the transaction status to "Filed". Note: this value cannot be forced for Utah/Idaho transactions. |

date (yyyy-mm-dd) | ✓ | |||||||||

| license_number |

License Number Only will import if a valid license number exists for the same physical state. If left blank, the system will default to the "Default License". |

varchar | ✓ | |||||||||

| filing_admin |

Filing Admin Assigned to Filing Only will import if a valid Filing Agency Admin or Filing Agent user exists in the company account. If left blank, the system will default to the Filing Task Assignment set by the user settings. |

varchar | ✓ | |||||||||

| migrated |

Indicates whether or not a transaction imported was part of the initial data migration or not TRUE = 1 |

tinyint(1) | ✓ |

Mapping Fees and Tax Titles

Broker Fees vs Carrier Fees

InsCipher separates fees into two buckets as these fees are taxed and reported differently depending on the state.

1) Broker Fees - These are an agency, policy, broker, filing, or other revenue-generating or reimbursement fees charged by or retained by the broker that is not mandated by the carrier.

2) Carrier Fees - These are inspection, audit, underwriting, or other fees charged or mandated by the carrier that is retained by the carrier.

It is important that when doing an import into InsCipher, your various fees get mapped to one of these two types so that our system can accurately determine the correct SL Tax calculations.

State Taxes and Fee Titles

InsCipher, by default, has certain state taxes and fees defaulted to these names:

-

- sl_tax - Surplus Lines Tax

- stamping_fee - Stamping Fee

- sl_service_charge - Surplus Lines Service Charge

- fm_tax - Fire Marshall Tax

- empa_tax - EMPA Tax

- municipal_fee - Municipal Tax

In some instances, we have chosen to rename tax titles for certain states instead of creating several custom fee fields. Here is a list of tax/fee titles that may vary from the default.

How Do Generic Lines of Business Import Codes Work?

InsCipher maintains a list of active coverage lists by state. To simplify the import process, we do not expect you to determine what these codes are on import. Instead, we have created Generic Import codes for you to use which can be found here. On the sheet, the generic codes (GEN-XXXX) are listed with the orange headers on the left side of the sheet. To the right, you will see state-specific codes listed with blue headers. If you import using the generic codes, then our system will automatically associate the transaction to the proper state-specific line of business upon import according to the mapping.

It is your responsibility to review the mapping and to determine if there are additional generic codes that need to be mapped or altered.

InsCipher will accommodate adding generic codes for you as part of the implementation process. These need to be requested via email and in one single request for all adjustments needed. If changes to this mapping are requested after implementation, clients will be charged an hourly rate to add these codes as it can be a time-consuming process.

Can I Import Documents In A Separate Step?

Yes, after transactions have been imported successfully, documents can be added in a separate step. To do this, please follow the instructions outlined here.

Immediate Response Format

API automatically returns a list of all policy numbers together with import status.

Success Response

{

"batch_id": "818b1a7f66c0f6f53de2248b8eb417d5",

"transactions": [

{

"id": "20190923002",

"policy_number": "CA20170228-09",

"transaction_id": 34748,

"status": 0,

"status_message": "Processing"

}]

}

After the policy data has been imported, you can then use the GET request below to get specific results.

Get Import Results Request

HTTP method:

GET

Get Import results (HTTP method: GET)

https://surpluslines.inscipher.com/api/v4/transaction-import-results.json?apikey=xxxxx&batch_id=yyyyyy

Initial Response

{

"batch_id": "912a654e961bb083981145c344ca40c6",

"status": "processed",

"transactions": [

{

"id": "201909240000000001",

"policy_number": "CA20170228-05",

"transaction_id": 34859,

"status": 0,

"status_message": "Success"

}]

}

Success Response + Warnings

{

"batch_id": "912a654e961bb083981145c344ca40c6",

"status": "processed",

"transactions": [

{

"id": "201909240000000001",

"policy_number": "CA20170228-05",

"transaction_id": 34859,

"status": 0,

"status_message": "Success",

"warnings": {

"lineOfBusiness": "Line of business is invalid.",

"total": "Transaction total values don't match. Provided - 4224.80. Calculated - 3407.98",

"slTax": "SL tax values don't match. Provided - 117.00. Calculated - 93.26",

"stampingFee": "Stamping fee values don't match. Provided - 7.80. Calculated - 6.22"

}

}]

}

Error Response

{

"batch_id":"f6272344cc2b5dccdaf24c9120ab77de",

"status": "processed",

"transactions":[

{

"id":"00001",

"policy_number":"ABC 0099",

"status":1001,

"status_message":"Error: missing required document with code 'POLIC'."

}]

}

Response Status (Batch) Codes

|

Status |

Description |

|

accepted |

The batch is accepted and scheduled for processing (transactions are not imported yet) |

|

waiting_for_processing |

Batch is waiting for processing |

|

in_progress |

Batch processing is in progress |

|

partial_processed |

Batch is partially processed - part of the import processing failed (this status is very unlikely - force majeure) |

|

processed |

Batch is processed |

|

failed |

Batch processing failed |

Response Status Codes

|

Code |

Name |

|

0 |

OK, accepted (Step 1), success (Step 2) |

|

1001 |

Error: Missing required documents |

|

1002 |

Error: Transaction type not found |

|

1003 |

Error: Transaction line of business is missing or invalid |

|

1004 |

Error: Department not found |

|

1005 |

Error: Unable to assign tax rule |

|

1006 |

Error: ECP (Exempt commercial purchaser) not provided |

|

1010 |

Error: Insurance company not provided |

|

1011 |

Error: Multi-State value not provided |

|

1012 |

Error: Customer physical state code is invalid |

|

1013 |

Error: Description of risk not found by real state and import code |

|

1014 |

Error: Transaction invoice number already exists in the system |

|

1015 |

Error: Missing state is required when physical address same as mailing |

|

2001 |

Error: Missing required fields |

|

3001 |

Error: Duplicate transaction is submitted |

|

5001 |

Error: Mailing insured name cannot be empty |

|

5003 |

Error: Agent cannot file in state |

|

6001 |

Error: upload document … size is too big, xMB is allowed |

|

6002 |

Error: document … are not reachable |

Available Warning Messages

|

Message |

Description |

|

total |

Transaction total values don't match. Provided - %.2f. Calculated - %.2f "Transaction total values don't match. Provided - 4224.80. Calculated - 4100.00" |

|

policyLimit |

policyLimit value %s are empty or not numerical. "policyLimit value ***** are empty or not numerical" |

|

insuranceCompany |

"Insurance company is invalid." |

|

slTax |

SL tax values don't match. Provided - %.2f. Calculated - %.2f "SL tax values don't match. Provided - 117.00. Calculated - 0.00" |

|

stampingFee |

Stamping fee values don\'t match. Provided - %.2f. Calculated - %.2f "Stamping fee values don't match. Provided - 7.80. Calculated - 0.00" |

|

premium |

State requires to round %spremium amount to nearest dollar. Imported %.2f, required %.2f |

|

fmTax |

FM tax values don\'t match. Provided - %.2f. Calculated - %.2f "FM tax values don't match. Provided - 5.00. Calculated - 0.00" |

|

slServiceCharge |

"SL service charge values don't match. Provided - 5.00. Calculated - 0.00" SL service charge values don\'t match. Provided - %.2f. Calculated - %.2f |

|

empaTax |

"Empa tax values don't match. Provided - 7.00. Calculated - 0.00" Empa tax values don\'t match. Provided - %.2f. Calculated - %.2f |

|

syndicateList |

"Total syndicate list coverage has to be 100%. (5 digits precision are supported)" Total syndicate list coverage has to be 100%%. (%s digits precision are supported) "Syndicate list breakdown is missing." |

|

lineOfBusiness |

"Line of business is missing." "Line of business is invalid." "Line of business breakdown is missing." |

|

insuranceCompanyItems |

"Total insurance company list coverage has to be 100%. (5 digits precision are supported)" Total insurance company list coverage has to be 100%%. (%s digits precision are supported) "Insurance Company List breakdown is missing, or incorrect list codes provided." |

|

rpgName |

"Purchasing group name not provided (RPG = 'yes')." |

|

ecp |

"ECP not provided." |

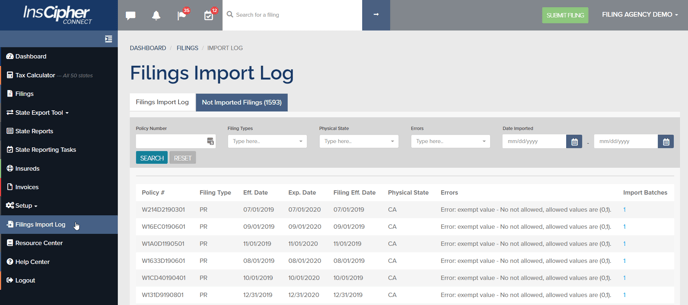

How Do I View And Correct Batch Import Errors?

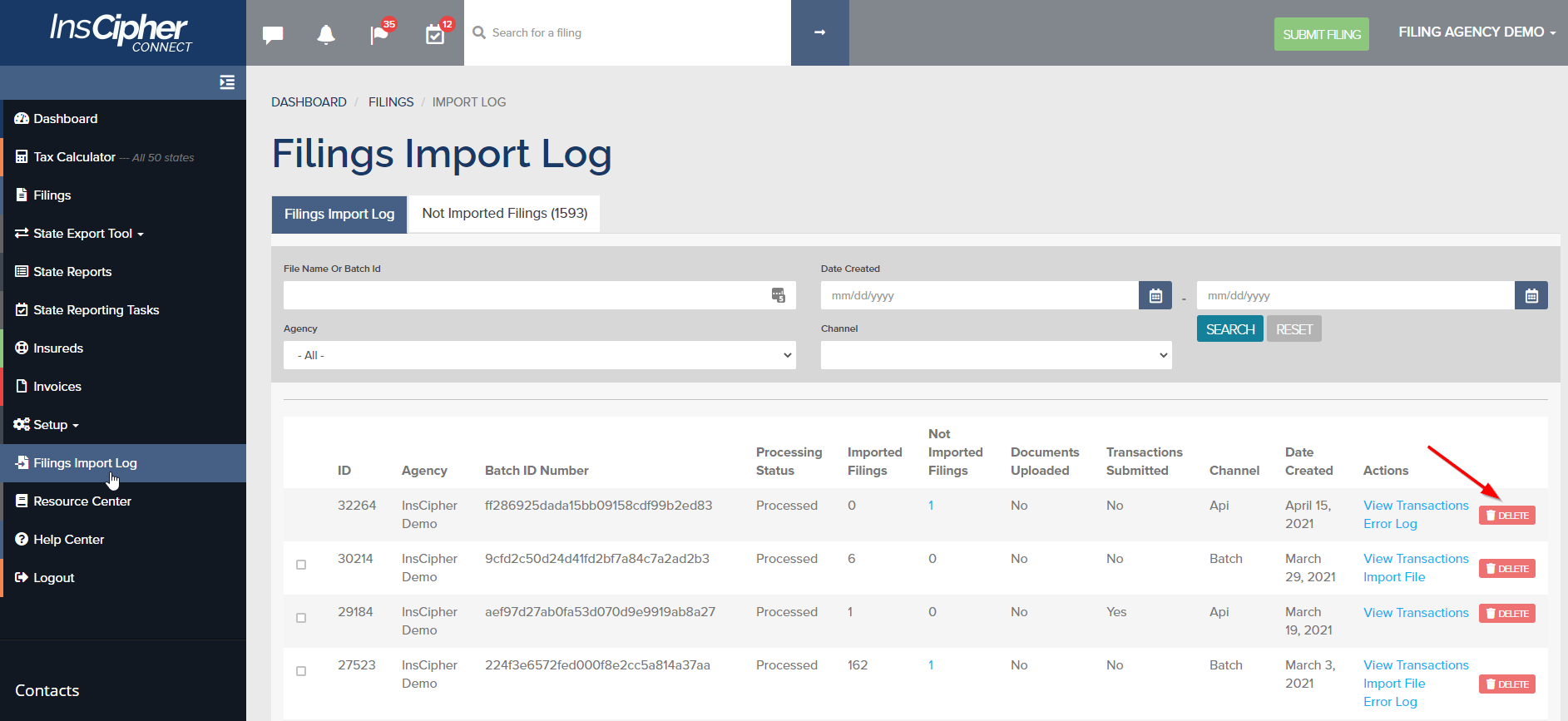

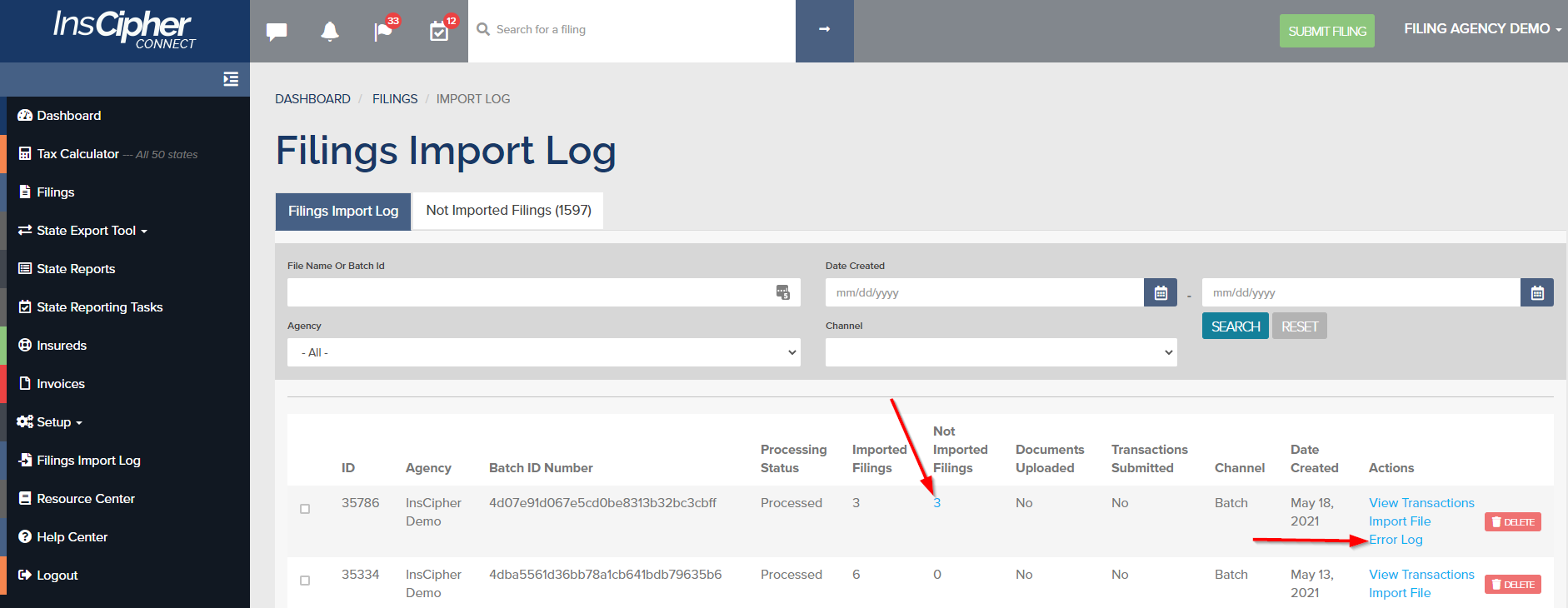

- If there are errors, you can go to the "Filings Import Log" page to identify the transactions that have errors and correct them.

- If there are many errors that came through on a batch, you can delete the entire batch by clicking the "Delete" button on the batch:

- You can also click under the "Not Imported Filings" or the "Error Log" to download a list of errors in the batch.

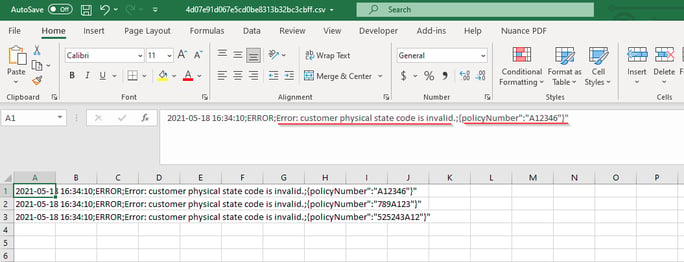

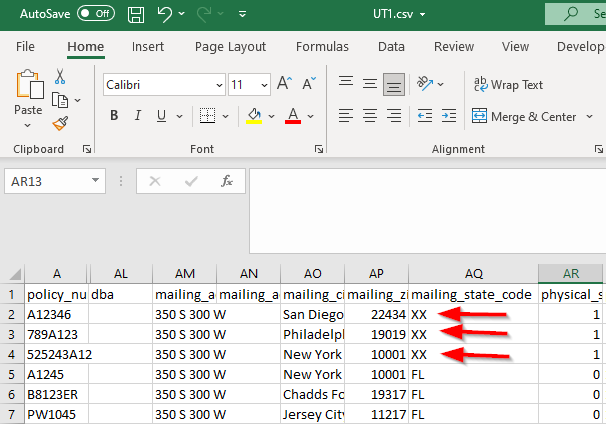

- When pulling up the error code list, you will see the reason for the error followed by the policy number that was trying to be uploaded.

- You will then need to go into the batch and correct the error.

Change History

| DATE | DESCRIPTION OF CHANGE |

| 4/11/2024 | Updated insured_entity description to include TX |

| 12/11/2023 | Updated SOP to include OK |

| 10/16/2023 | Fixed typo in DC sample code |

| 9/22/2023 | Clarified declining carrier fields and added associated producer |

| 6/26/2023 | Added API key in header option. Added collection fee to json request for KY. |

| 5/24/2023 | Added CA to declining carriers and retail producer |

| 10/13/2022 | Removed export_list field |

| 9/16/2022 | New fields added: property_limit, layered_risk, broker_of_record, risk_retention_group, multiple sos and dc fields. Updated formatting on a number of fields and clarified some descriptions. Added new mapping report for Declining Carrier and Policy Limit details. |

| 3/14/2022 | Added windstorm exclusion and deductible fields. |

| 2/1/2022 | Added links to new FS Mapping Packet, UMR number, SLA transaction number, clarified language related to syndicate list. |

| 12/6/2021 | Added new Transaction Types to the mapping section |

| 8/27/2021 | Added new import fields for NJ (UMR number, and NJ Transaction Number) + Added new fields for data migration (Stamping Fee Paid Date, SL Tax Paid Date, Date Filed, Transaction Status, Unique ID, License Number, Filing Admin) |

| 8/17/2021 | Added section for mapping fees and tax titles (V4.1) |

| 7/28/2021 | Updated format of Version History |

| 7/20/2021 | Changed description of Export List being set to NULL > to being set to "0" and added version history |

| 7/13/2021 | Updated description of GET Status Response |

| 7/3/2021 | Released V 4.0 |