Pay your Idaho, Utah and InsCipher Invoices Online!

Paying invoices online is required for paying Idaho, Utah, and InsCipher Filing Services invoices. InsCipher has waived all processing fees associated with the ACH payment. InsCipher has improved our online payment experience. Some of the features of this new system include:

- The ability to create and save payment profiles to securely store your ACH information for future invoice payments

- The ability to pay different invoice types with different bank accounts

- Payments will be processed in 1-2 business days. You will continue to be notified via email when a payment is submitted and when that payment processes.

- Credit balances will automatically get applied to future invoices. No longer will you have to manually associate credit invoices to future positive invoices. Your future invoices will reflect any previous credit amounts as a line item on the invoice.

SHOULD YOU HAVE QUESTIONS ON HOW THIS WORKS, WATCH THIS QUICK TUTORIAL OR REVIEW THE GUIDE BELOW!

Viewing Invoices

To view invoices, click on "Invoices" on the left navigation bar then click on PDF or CSV to download the invoice details. The invoice header names are defined below:

Header Definitions - Applicable to ALL Filing Submissions

- SLT: Surplus Lines Tax

- SF: Stamping Fee

- LCF: Late Charge Fee (Assessed by State)

- Total: Total Amount Owed

Header Definitions - Applicable ONLY to InsCipher's Filing Service Clients

- SLSC: Surplus Lines Service Charge - Applicable to a handful of states (Example: Oregon).

- MF: Municipality Fee (Kentucky Only).

- FM: Fire Marshall Tax - Applicable to a handful of states (Example: Illinois on certain lines).

- EMPA: Emergency Management, Preparedness, and Assistance Trust Fund (Florida only on certain lines).

- FF: Filing Fee - InsCipher charge to file policy detail to states.

- State Fee: State Fee (Example: Opt-ins Fee).

- LSF: Late Submission Fee - InsCipher charge for policies submitted after 30 days from Transaction Effective Date.

PDF Example

_pdf-3.png)

CSV Example

_csv+-+Excel-3.png)

Invoice Types

Invoices will be categorized into four types listed below:

SLA of Idaho - Starting with Nov 1, 2020 Invoice

- SF: Stamping Fees - Assessed at current Idaho SLA rate

- LCF: Late Charge Fees - Assessed by the SLA of Idaho for any late submissions

Both these fees will be paid directly to the Surplus Line Association of Idaho using the InsCipher online payment system, powered by PaySimple™. Checks will no longer be accepted. Making payments online for this Invoice Type is easy. Refer to the Paying Invoices section below for more information on how to pay this invoice type.

SLA of Utah

- SLT: Surplus Lines Tax - Assessed at the current Utah DOI rate.

- SF: Stamping Fees - Assessed at the current Idaho DOI rate.

- LCF: Late Charge fees

These fees will be paid directly to the Surplus Lines Association of Utah using the InsCipher online payment system, powered by PaySimple™. Checks will no longer be accepted. Making payments online for this Invoice Type is easy. Refer to the Paying Invoices section below for more information on how to pay this invoice type.

Other Invoice Types - Specific to InsCipher Filing Service Clients

Starting Sep 22, 2020, your invoices will be broken out into two invoice types:

1) State Taxes and Fees

- SLT: Surplus Lines Tax

- SF: Stamping Fee

- LCF: Late Charge Fee (Assessed by State)

- SLSC: Surplus Lines Service Charge - Applicable to a handful of states (Example: Oregon).

- MF: Municipality Fee (Kentucky Only).

- FM: Fire Marshall Tax - Applicable to a handful of states (Example: Illinois on certain lines).

- EMPA: Emergency Management, Preparedness, and Assistance Trust Fund (Florida only on certain lines).

- State Fee: State Fee (Example: Opt-ins Fee).

2) InsCipher Filing Fees

- FF: Filing Fee - InsCipher charge to file policy detail to states.

- LSF: Late Submission Fee - InsCipher charge for policies submitted after 30 days from Transaction Effective Date.

Invoices for these types can be paid with the same bank account or with different bank accounts. Invoice types will be indicated on the invoice itself and in the invoice list page.

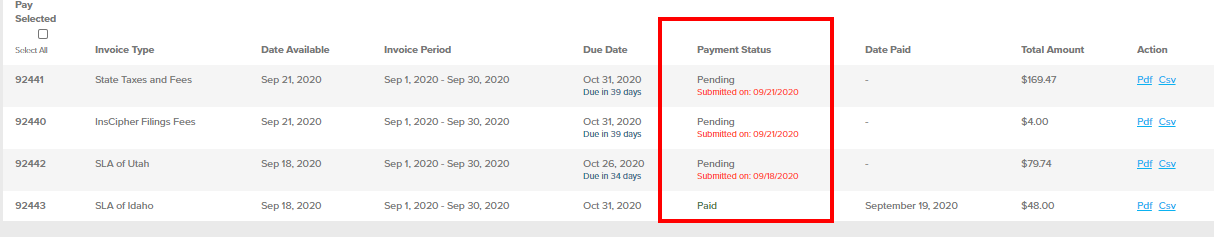

Invoice Status

The payment status is shown in the invoice list view. Invoice statuses are defined below:

- Unpaid: A payment needs to be completed by the payment deadline to avoid late charge fees from being assessed.

- Pending: A payment that has been submitted but has not yet cleared the bank. Payment typically takes 1-3 business days to process. Late fees are assessed by the date the payment was submitted and not the date the payment was processed.

- Paid: A payment has been successfully processed and approved.

- Failed/Declined: The submitted payment failed to process. The reason for the failed payment will be included with the failed payment notification e-mail. Typically, failed payments are due to inaccurate payment information provided, insufficient funds, or your bank prevented InsCipher from debiting your bank account (can be prevented by having your bank add InsCipher, LLC to their "white list".

BELOW IS FOR INSCIPHER CLIENTS ONLY (Does not apply to other user types)PAYEE ORIGINATOR ID SLA of Utah 6475487609 SLA of Idaho 8475487609

INVOICE TYPE ORIGINATOR ID InsCipher's Filing Fees 5475487609 InsCipher's SL Taxes and Fees

- Not Related to Utah/Idaho Invoices

7475487609 - Credit - There is a positive balance associated with your account. Moving forward, any credits would automatically be applied to your outstanding balance.

Paying Invoices

When paying invoices online you will first need to create a new payment profile. A payment profile is used to store your payment information in a secure database for future use.

IMPORTANT:

You will want to confirm that InsCipher, LLC has been added to your banking institution's "white list" to remove any blocks that would interfere with processing the payments. The ACH ID#s to provide to your banking institution are listed below:

| PAYEE | ORIGINATOR ID |

| SLA of Utah | 6475487609 |

| SLA of Idaho | 8475487609 |

| INVOICE TYPE | ORIGINATOR ID |

| InsCipher's Filing Fees | 5475487609 |

|

InsCipher's SL Taxes and Fees - Not Related to Utah/Idaho Invoices |

7475487609 |

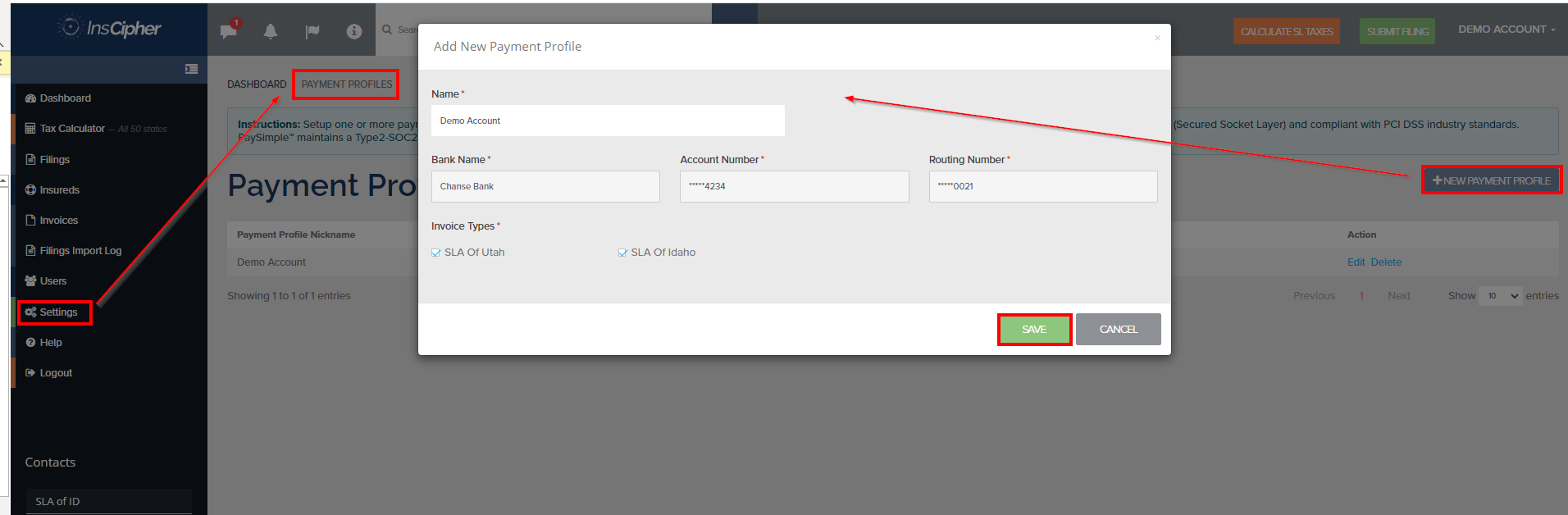

Setting Up a Payment Profile

Payment profiles are required when paying invoices online. Setting up a payment profile is simple to do. You can choose to have a single payment profile for your agency for all invoice types or have multiple bank accounts for each invoice type. When setting up a payment profile, you have the ability to select which option works best for your accounting workflows.

Note: When a payment profile is created, the data is stored encrypted in the PaySimple™ database. No other users or InsCipher personnel can access this data. Only the last four digits of the account number will display to the user.

AGENCY ADMIN USERS (IDAHO & UTAH):

To set up a payment profile, follow these simple steps

- Go to Settings > Payment Profiles

- Click on the +NEW PAYMENT PROFILE button

- Add a Payment Profile name, Bank Name, and Account/Routing Information

- Determine the applicable invoice types, whether it be for the "SLA of Idaho" or the "SLA of Utah". Note: if you select one invoice type, you will need to create a different payment profile for the other invoice type not included in order to pay invoices for that state.

- Click SAVE to save the payment profile. Afterward, you can proceed with paying your outstanding invoices online.

- Should you need to change payment information, click the Edit or Delete action buttons in the Payment Profile list view.

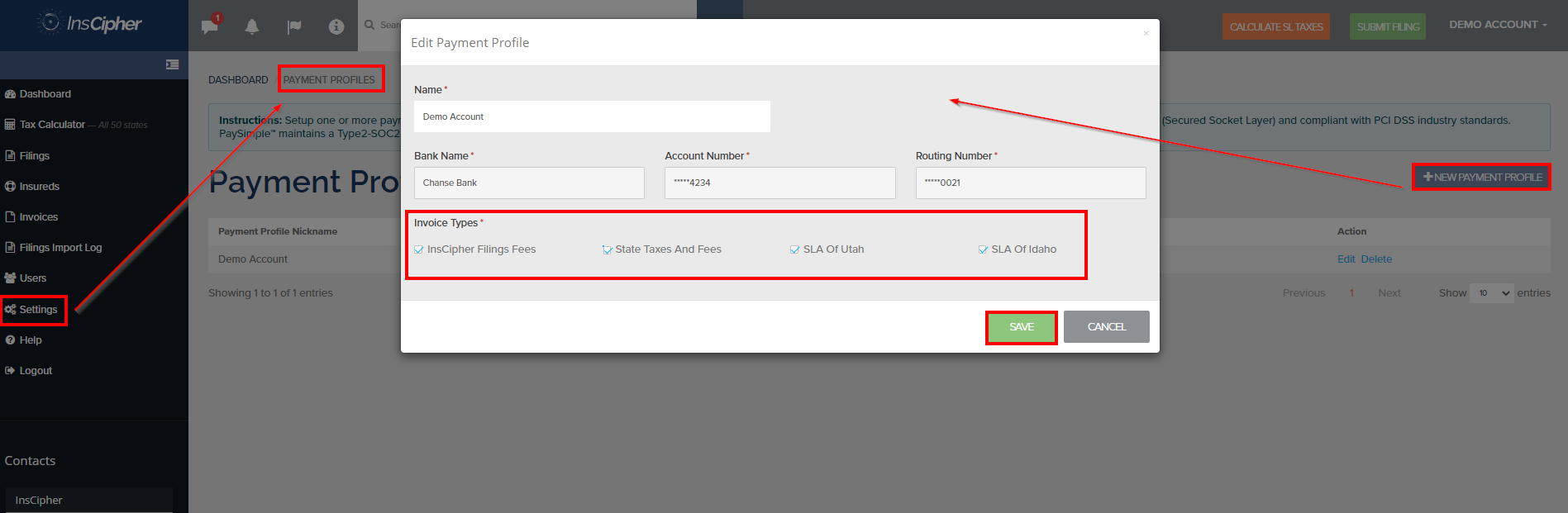

AGENCY ADMIN USERS (INSCIPHER FILING SERVICE CLIENTS):

To set up a payment profile, follow these simple steps

- Go to Settings > Payment Profiles

- Click on the +NEW PAYMENT PROFILE button

- Add a Payment Profile name, Bank Name, and Account/Routing Information

- Determine the applicable invoice types, whether it be for the "SLA of Idaho", "SLA of Utah", "State Taxes and Fees", and "InsCipher Filing Fees". Note: if you select one invoice type, you will need to create a different payment profile for the other invoice type not included in order to pay invoices for that invoice type.

- Click SAVE to save the payment profile. Afterward, you can proceed with paying your outstanding invoices online.

- Should you need to change payment information, click the Edit or Delete action buttons in the Payment Profile list view.

INSCIPHER CONNECT® USERS:

To set up a payment profile as a Filing Admin that manages the filings out of the InsCipher Connect® platform, the setup process is similar with just a few additional options:

- Go to Setup > Payment Profiles (if you don't see this page or have permission to access, contact your Filing Company Admin)

- Click on the +NEW PAYMENT PROFILE button

- Add a Payment Profile name, Bank Name, and Account/Routing Information

- Determine if you want the profile for All Agencies or a single agency. Note: if you select a single agency, you will need to create a different payment profile for the agencies not included in order to pay invoices for that agency.

- Determine the applicable invoice types, whether it be for the "SLA of Idaho" or the "SLA of Utah". Note: if you select one invoice type, you will need to create a different payment profile for the other invoice type not included in order to pay invoices for that state.

- Click SAVE to save the payment profile. Afterward, you can proceed with paying your outstanding invoices online.

- Should you need to change payment information, click the Edit or Delete action buttons in the Payment Profile list view.

Paying Invoices

To pay outstanding invoices, navigate to the "Invoices" page by clicking on the link on the left navigation bar. Next, click the box next to the invoice you wish to pay. Note: you can pay multiple invoices at once for different invoice types, assuming that you have set up a Payment Profile for that type. If you have not set up a Payment profile, a warning message will appear preventing you from making a payment. To add or edit a Payment Profile, click on the EDIT PAYMENT PROFILES button. Once your Payment Profiles are set and you have selected the appropriate invoices, click the green PAY NOW button. Doing so will cause a popup to appear with your "Payment Summary", which includes a breakout of each invoice amounts, the bank account used for each invoice type, and a payment total. After you have reviewed the payment summary and agree to the Terms and Conditions, and then click the SUBMIT PAYMENT button to process the payment.

Status Updates and Email Notifications

When you make a payment online, the status of the payment will change from "Unpaid" to "Pending". The user that made the online payment will receive an automated email notifying that the payment has been made and is currently being processed. Typically it will take 1-3 business days for the payment to fully clear. Once the payment clears, the user that made the payment will get a second notification that specifies if the payment cleared successfully or failed. If the payment fails, the reason will be included in the message. Typically, failed payments are a result of your agency's bank blocking the online payment, which is why we highly recommend that you get InsCipher, LLC whitelisted to make ACH debits from your account. Once the payment has successfully cleared, the status of the invoice will change to "Paid".

Security Protocols

Payment information is kept encrypted and is powered by PaySimple™. Processing is performed by SSL (Secured Socket Layer) and compliant with PCI DSS industry standards. PaySimple™ maintains a Type2-SOC2 certification. For more information, visit https://paysimple.com/security.

FAQ

Q: How is my payment information stored?

A: When making online payments after Sep 22nd, you will be required to set up a "Payment Profile" and associate that to one or more invoice types. More information to follow of how to do this exactly. When a payment profile is created, the data is stored encrypted in the PaySimple™ database. Only the last four digits of the account number will display.

Q: Why do I need to setup Payment Profiles?

A: First of all, it will make paying online very fast! All you need to do is set up your Payment Profiles one time. Moving forward, paying invoices will be very quick, as your payment information will automatically be associated with the selected invoice types. This works similarly to buying products off of Amazon. InsCipher and PaySimple™ are using the same encryption technology to ensure that your payment information is kept safe and secure. If you are a filing service client and receive multiple invoices from InsCipher and you wish to pay each using different bank accounts, setting up different Payment Profiles will allow you to make multiple invoice payments of different types all at once in just a couple of quick clicks. Secondly, it will help cut down on the risk of failed payments that may result in a bounced check fee.

Q: How do I setup Payment Profiles?

A: More information to come on how to set this up with screenshots and a quick tutorial video. It is a quick process.

Q: What if I am a Connect® client of InsCipher and make payments for multiple agencies out of my user account at the same time currently; how will this work?

A: We have you covered. You will have the ability to create payment profiles for your different agencies and then pay all invoices at once. Just select which invoices you want to pay, and the appropriate payment profile will be associated with the invoice or invoices selected based on your payment profile settings. This may sound complicated but is actually very easy to setup. Once you get this setup, making future payments out of InsCipher for Utah or Idaho will be a breeze!

Q: Are paying invoices online required or can I pay with a check?

A: Idaho, starting on Nov 1, 2020, will require all stamping fee payments to be made online. SLA of Utah has a similar policy where payments for Stamping Fees and SL Taxes are to be paid online. If you attempt to pay with a check, you will likely be assessed a separate check fee. Starting on Nov 1, 2020, all InsCipher Filing Service clients are required to pay their invoices online. In all cases, no partial payments will be accepted.

Q: What if I have a credit balance, will I get a refund check?

A: In all cases, credit balances will be applied to future invoices automatically. Neither Idaho, Utah nor InsCipher Filing Services will refund credit balances unless an outstanding balance extends beyond a year. With the new payment system, there is no need to manually apply credits to future balances as this will automatically be done for you with the new payment system.

Idaho may waive the one-year term at their discretion, for example, in cases of a license termination or surrender.

Additional Questions?

-

Idaho Brokers: Email Carrie or Amalia Negrette at support@idahosurplusline.org

-

Utah Agencies: Email Sylvia Bruno at sbruno@slaut.org.

-

InsCipher's Filing Service Clients: Email filingservices@inscipher.com

Related articles

- Tax Exempt Status by State

- IDAHO - Frequently Asked Questions

- UTAH - Frequently Asked Questions

- Confirming Insured Information

- Submitting Filings for UTAH

| Date | Edit |

| 3/1/23 | Updated ID's email address |

| 12/7/22 | Reviewed for accuracy |