This article is designed to help you learn how to use the Transaction CSV batch import tool in InsCipher.

Watch this 8 Min Tutorial

Table Of Contents

- Instructions on How to Use Batch Import Tool

- Troubleshooting Import Errors

- Description of Field Names on CSV File

- Historical Data Migration

- Field Mapping Documentation

- What About Attaching Documents?

- Change History

How Do I Perform a Batch Import of Policy Transactions?

- Download a policy details report from your policy management software and convert this file to a .csv format. Many policy management systems allow for the exporting of policy details reports to a .csv file. However, some may not, and it may be required to convert the report from a .xls(x) format to a .csv format using a program like MS Excel. Regardless, in order to proceed to the next step, you will need to ensure that the file format is saved as a .csv.

Note: Previously, it was required that you use our required sample file in order to import policy transactions into the InsCipher portal. This is no longer required! You may still utilize this same file, should you already have a process built out for this. Download the sample file by clicking here. Descriptions of the headers can be found in the sample file.

- After you have your file, on the left navigation bar, go to Upload Filings > Batch Import

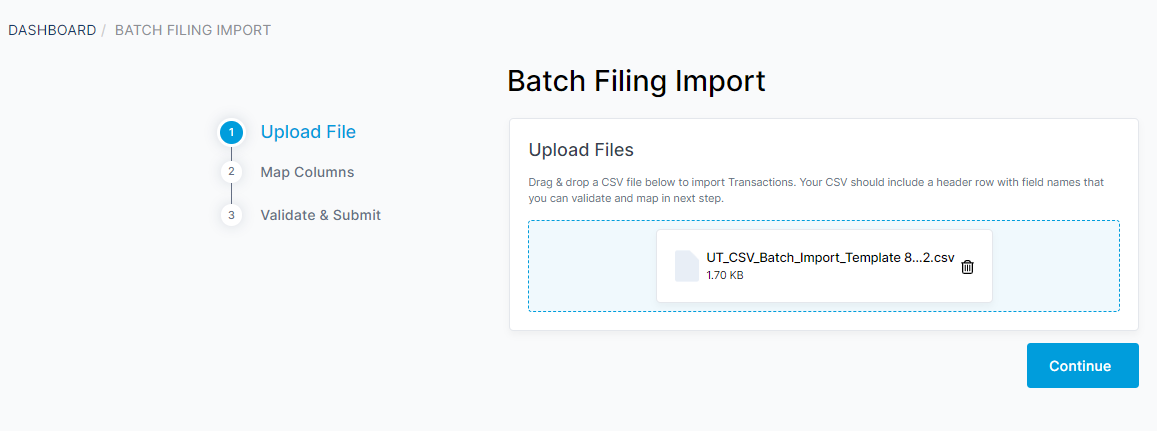

- On step 1 of the CSV import process, select your CSV file. Then click "Continue" to proceed to Step 2 - Map Columns.

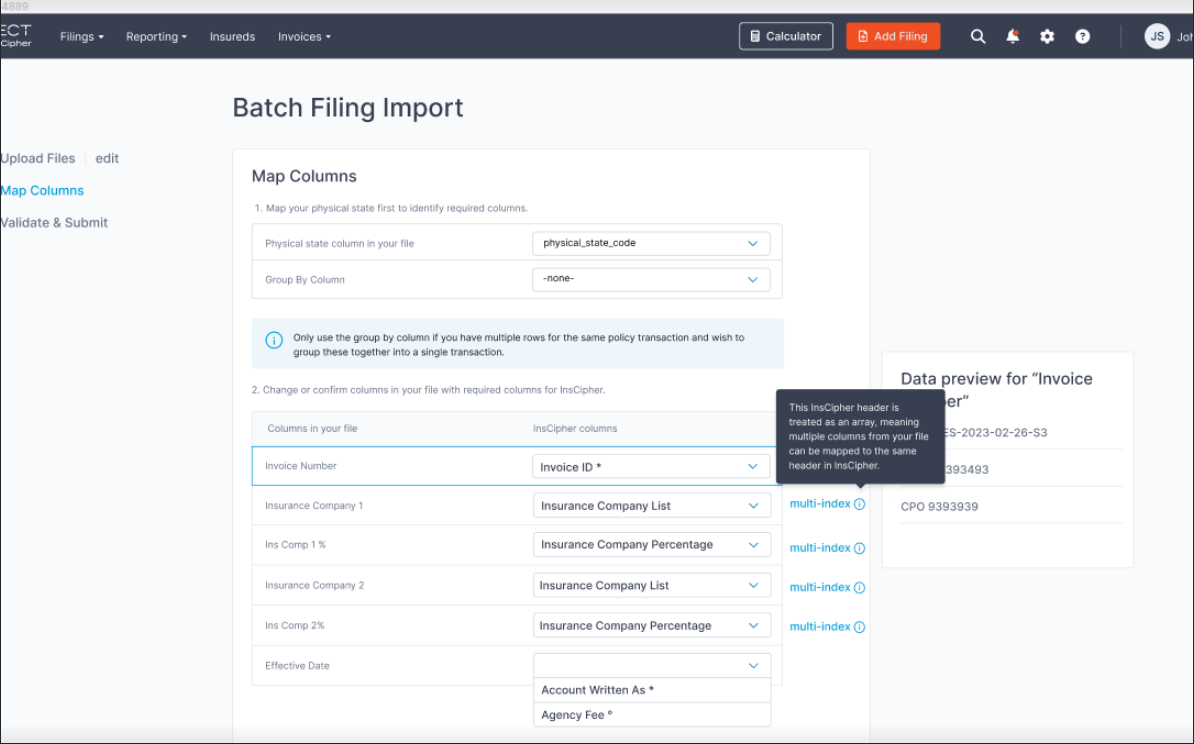

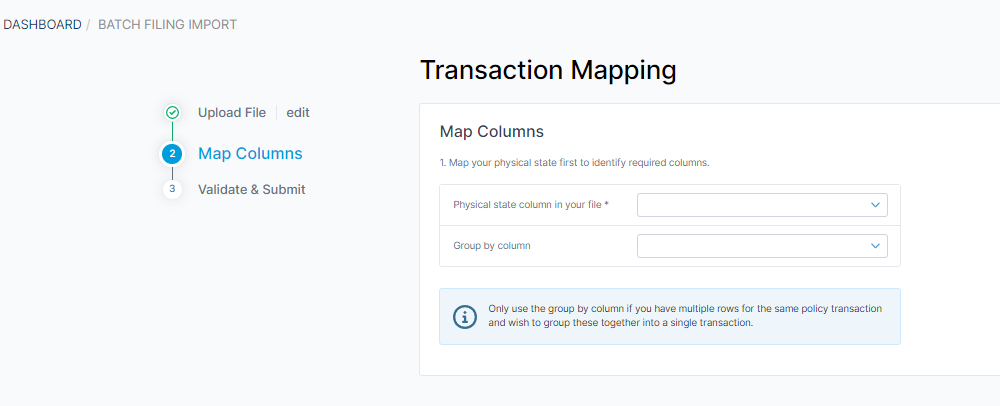

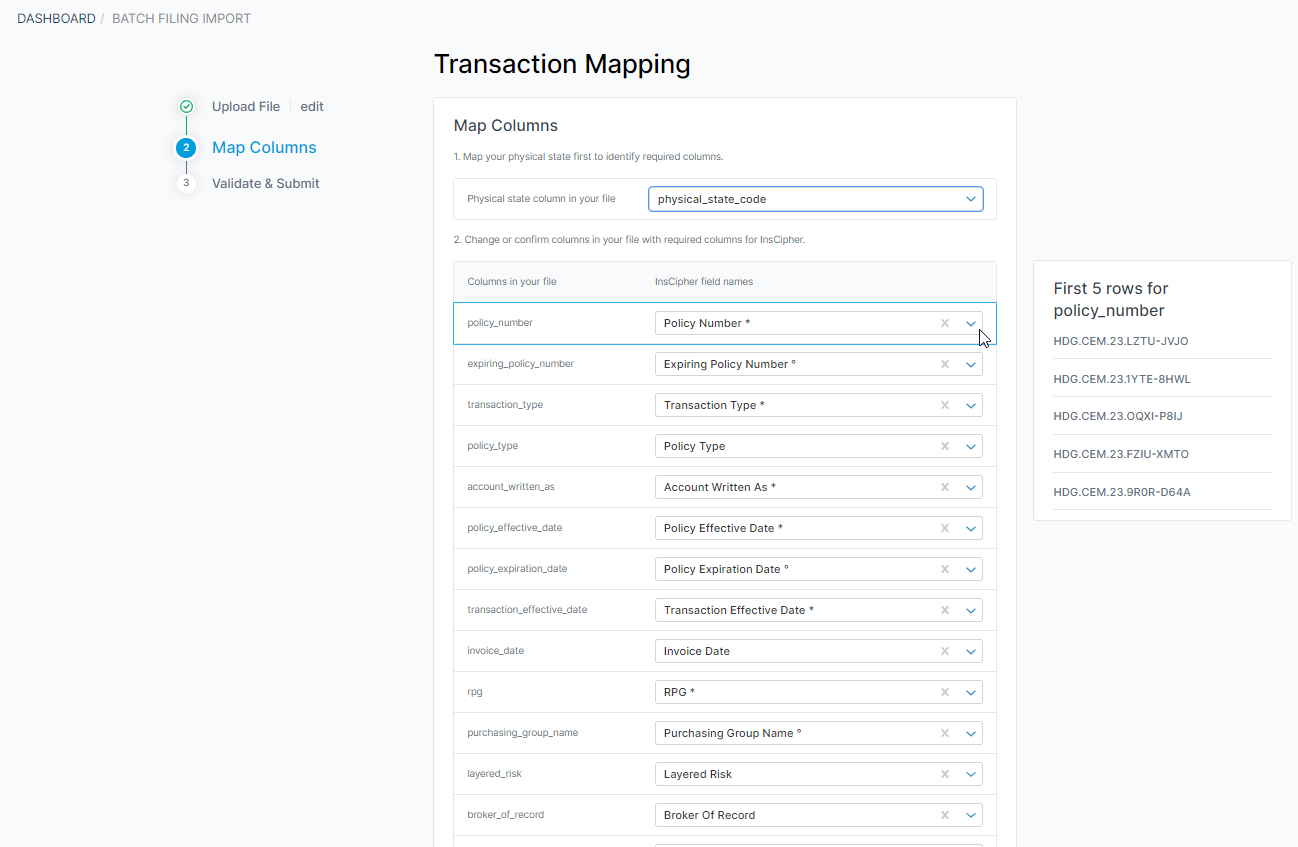

- In step 2 of the CSV import process, you will need to map the columns from your policy transaction report to the required headers in the InsCipher portal.

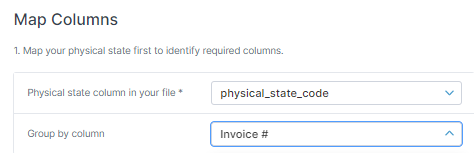

- Part 1 is to select the column that contains the physical/risk state of the policy transactions. If you use our import sample file, this will be called "physical_state_code". However, if you are using your own file, it may be called something different. Should you be using a file that has multiple rows for the same transaction, you can also use the option to "Group By Column". If your policy details for a single transaction is on one row, then leave these value blank.

- Part 2 will be to map all the remaining headers in your file.

FYI! The nice thing about this feature is that we save the mappings you perform on this step so the next time you attempt to import transactions, the mapping will already be done for you!

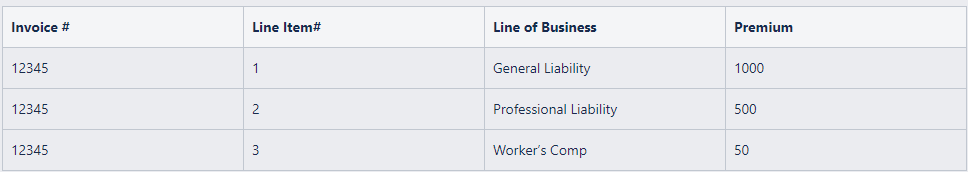

- This new batch import process allows for CSV files with multiple rows or multiple columns.

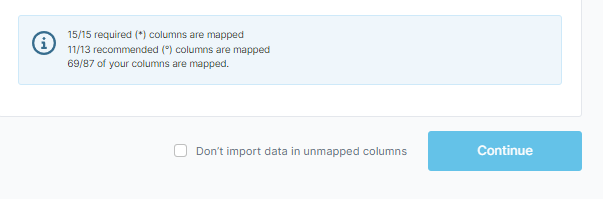

- A summary is then provided at the bottom of the page. If you don't wish to map optional columns, then these values will not be imported.

Important! You must map all required columns in order to proceed to the next step. However, to push transactions to a "Submitted" status, all recommended columns must be mapped as well. All other columns are optional. Click on the "Don't import data in unmapped columns" if you wish to bypass mapping all columns in your file.

- Part 1 is to select the column that contains the physical/risk state of the policy transactions. If you use our import sample file, this will be called "physical_state_code". However, if you are using your own file, it may be called something different. Should you be using a file that has multiple rows for the same transaction, you can also use the option to "Group By Column". If your policy details for a single transaction is on one row, then leave these value blank.

-

Tips!

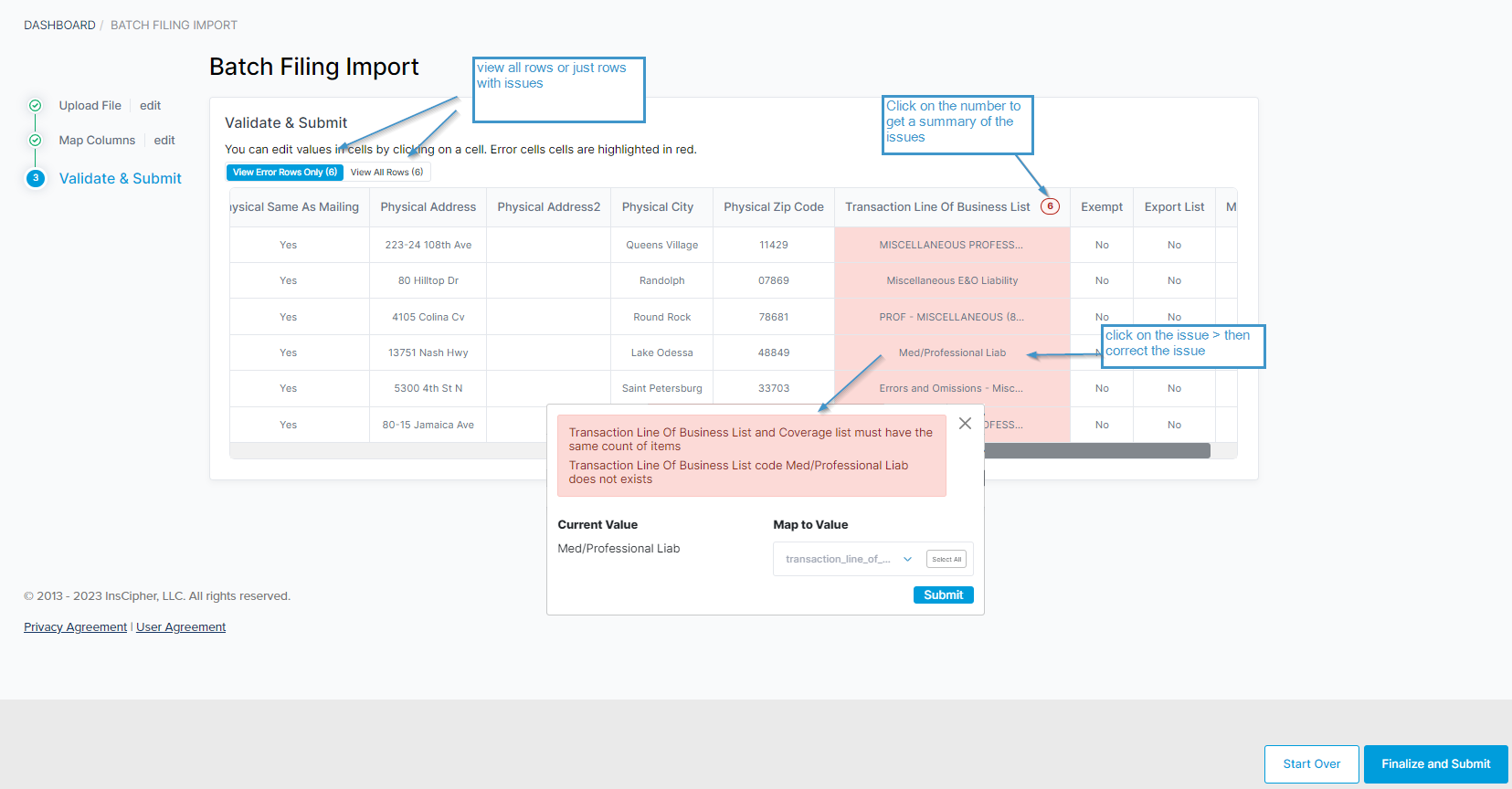

- Click on the number on the column headers that contain issues to get a summary of the issues.

- Look for patterns. If there are errors that apply to multiple rows, use the "Select all" option to apply to all affected rows when fixing a specific issue/field.

- Should there be a lot of errors that make it difficult to proceed, consider fixing your underlying file and starting over.

- If you have questions about the header descriptions or accepted values, refer to the table below step 3 requires you to do a review and correct data on any rows that have errors. By default, only rows with errors will appear in this step, but you can view all shows as well with the toggle.

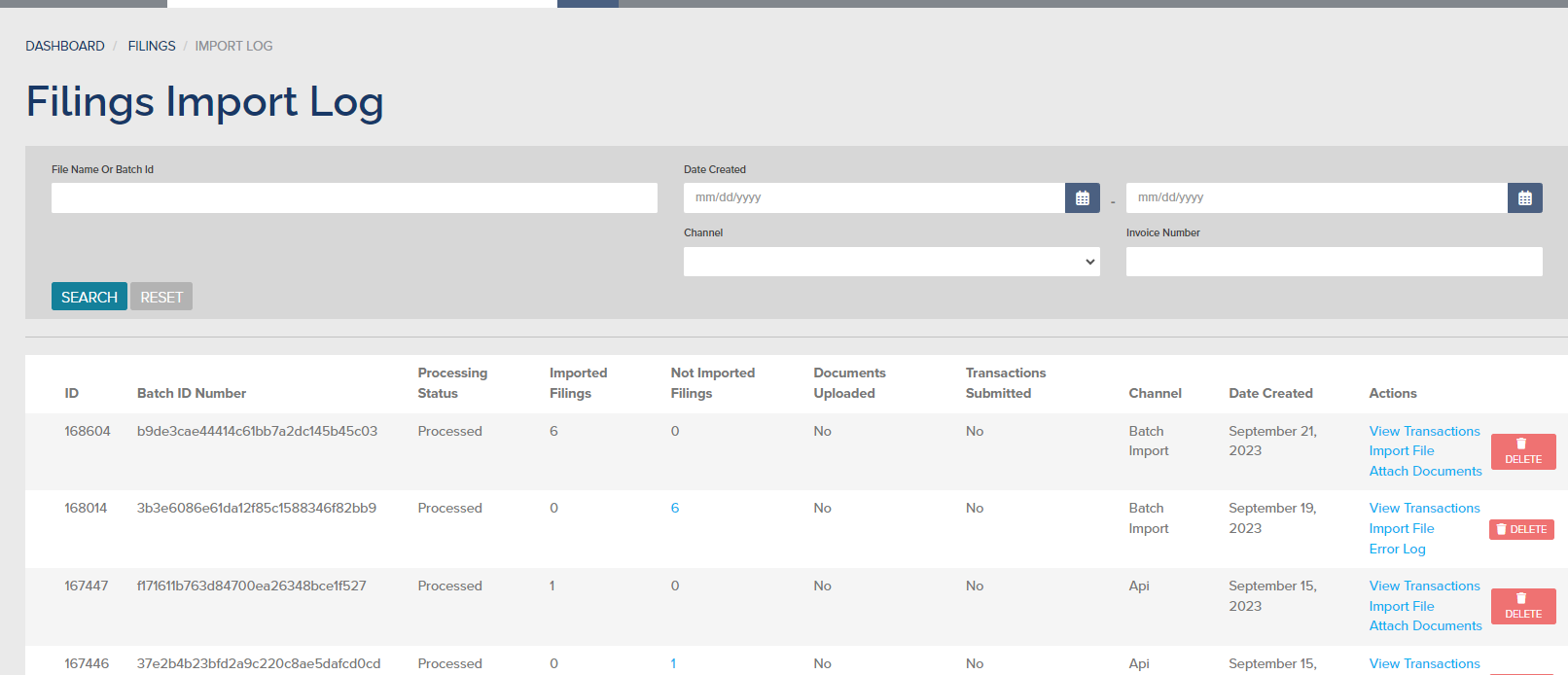

- If you are just importing a CSV, after you click "Continue" your file will be scheduled for import. Should you have any import errors, these will be displayed on the "Filings Import Log".

How Do I Correct a Batch if There are Errors?

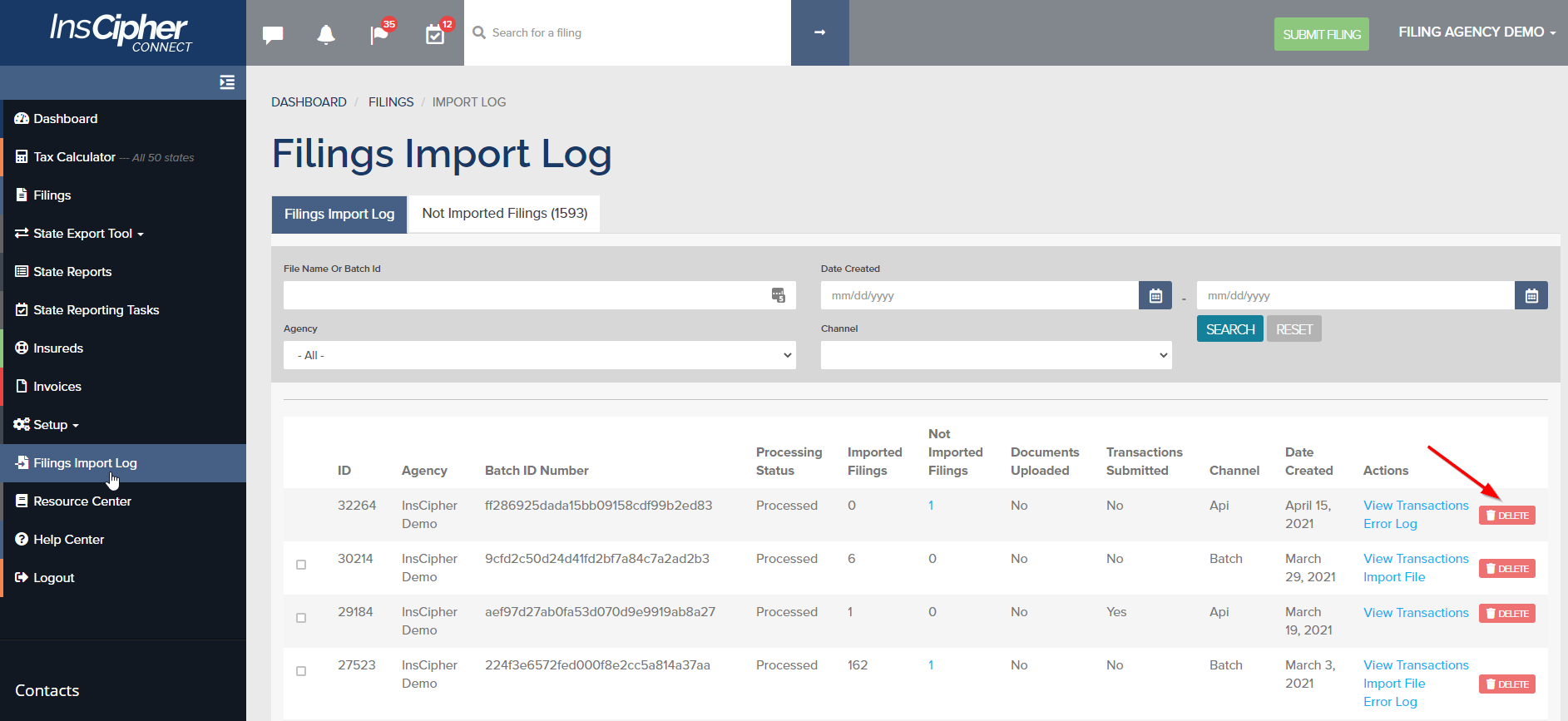

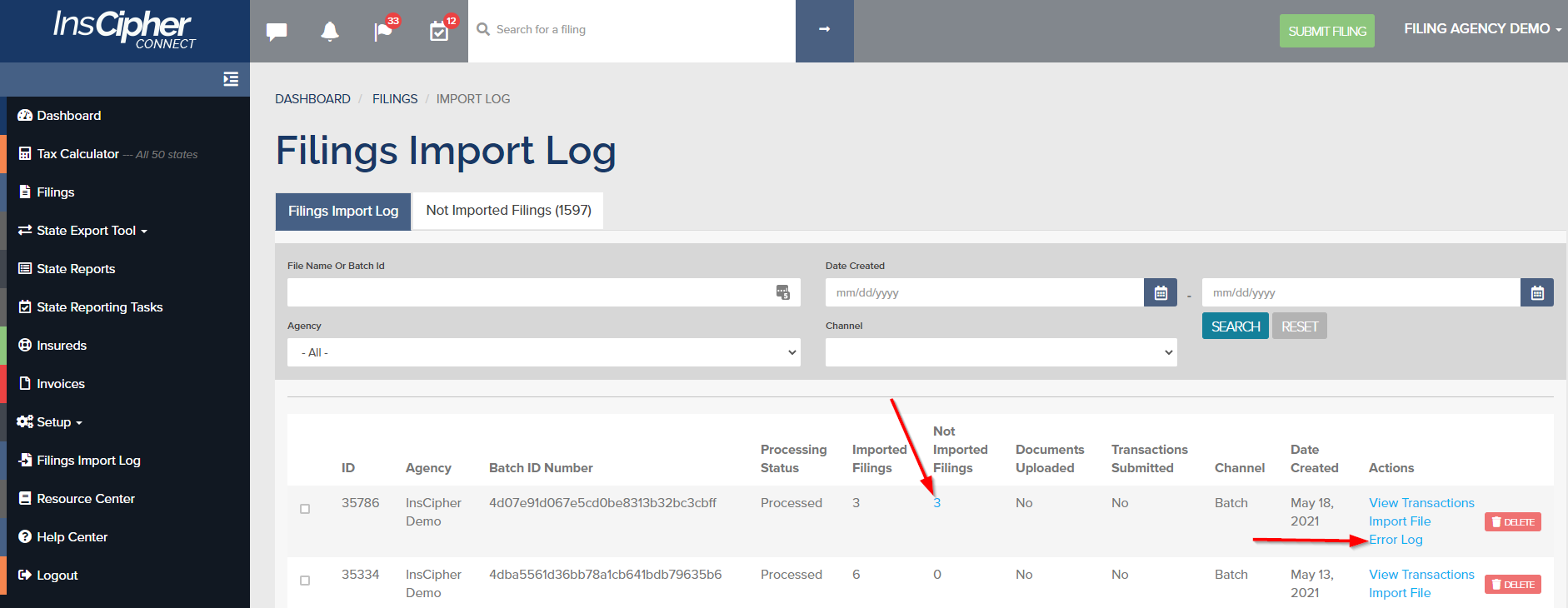

- If there are many errors that came through on a batch, you can delete the entire batch by clicking the "Delete" button on the batch:

- You can also click under the "Not Imported Filings" or the "Error Log" to download a list of errors in the batch.

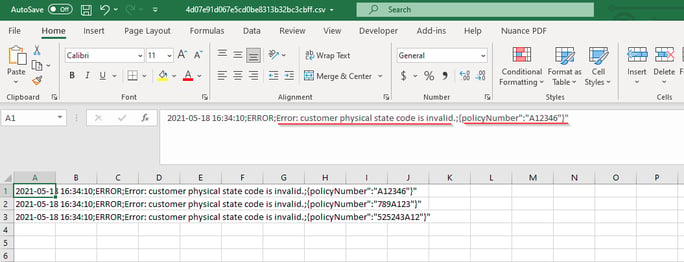

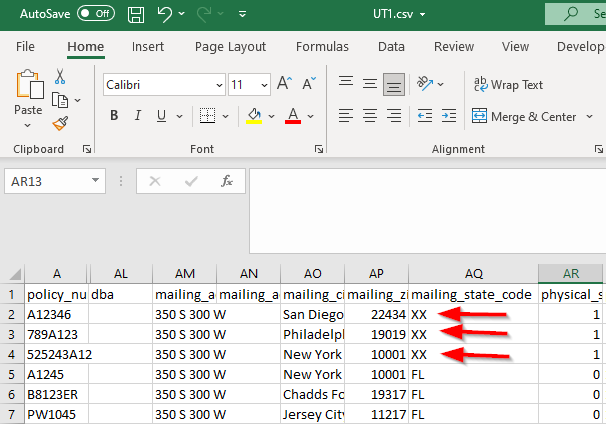

- When pulling up the error code list, you will see the reason for the error followed by the policy number that was trying to be uploaded.

- You will then need to go into the batch and correct the error.

Field Descriptions

Below, you will find a list of the different fields used, the description, and whether or not it is required for the CSV batch import to work.

Note: Some fields are required in order for the transaction to import without error. Others are listed as "required" on the CSV spreadsheet since they are needed to load accurate policy/endorsement information but won't actually cause an error if they are missing at the time of import. There are additional codes that you can find at the bottom of this document such as insurer NAIC codes, description of risk, and lines of business.

Note: Please follow the formatting instructions listed on the CSV import template. For example, dollar symbols and commas must be removed from all currency fields prior to importing.

Field Descriptions

|

Headers from Sample File |

Description |

Required |

||||||||

|

policy_number |

Policy number. Non-unique field. |

✓ |

||||||||

|

policy_effective_date |

Policy effective date |

✓ |

||||||||

|

policy_expiration_date |

Policy expiration date |

✓ |

||||||||

|

transaction_effective_date |

Transaction effective date For endorsements, this is the endorsement date. For New/Renewal policies, this is equal to the policy effective date. If omitted, today's date is used as transaction eff. date |

✓ |

||||||||

|

expiring_policy_number |

Expiring Policy Number Only Required for Renewal type policies. |

Depends |

||||||||

|

invoice_date |

This is the date that the policy was invoiced in most states. In GA, this is the Revenue Recognition Date, in HI, this is the Date Issued. In Idaho, this is the Broker Received Date. If omitted, the filing effective date will be used. |

Depends |

||||||||

|

invoice_number |

This is the invoice number (or unique transaction ID) generated by your Agency Management System (AMS). This number allows users to trace imports to existing transactions within the management system as is a value we recommend importing. This number will be used to identify possible duplicate transactions. Identified duplicate transactions will be excluded from being imported. |

|

||||||||

|

transaction_type |

Updated transaction types can be found here. |

✓ |

||||||||

|

policy_type |

Options include "standard", "master", or "cert" If unknown, choose "standard" or leave blank |

|

||||||||

|

account_written_as |

Use one of these two options: Brokerage = B Direct Client = DC Use "B" if you sell through a retail agent. Use "DC" if the policy is sold directly to the insured. If omitted, the default Agency Admin setting will be used |

|

||||||||

|

rpg |

Risk Purchasing Group? Yes = 1 |

✓ |

||||||||

|

layered_risk |

Layered Risk Yes = 1 No = 0 |

|

||||||||

|

broker_of_record |

Broker of Record Change Yes = 1 No = 0 |

|

||||||||

|

risk_retention_group |

Risk Retention Group Yes = 1 No = 0 |

|

||||||||

|

purchasing_group_name |

Required if RPG (rpg field) is set to Yes (or 1). If not included and RPG = Yes, then the transaction will still import but will show RPG error. |

Depends |

||||||||

|

risk_description |

Description of Risk For New York, Ohio, and Pennsylvania, we require specific import codes to be used when importing. For all other states, import this as a text value description of the coverage. See this table for a list of the state-specific codes. To download the table, hover over the top right corner of the table, click on the three dots, and then export to CSV. |

Depends |

||||||||

|

ecp |

Exempt Commercial Purchaser? No = 0 If omitted, 0 (zero) value will be imported. Unless you know what this is, set this value to 0. |

|

||||||||

|

exempt |

Is the Insured/Entity considered tax-exempt by the state? Exempt Yes = 1 Unless you know that the insured/Entity is Tax Exempt, set the value to 0 or leave it blank (the system will default to 0). Currently Required only for the state of Utah. |

|

||||||||

|

multi_state |

Does the insured’s liability reside in multiple states? Multi state Yes = 1 InsCipher does not calculate Multi-state surplus lines tax breakdowns. With NIMA dissolving in 2016, InsCipher reports 100% of the premium to the home state of the insured and bases the tax percentages off that state. If omitted, the default is No (0). There are only a few states where InsCipher has enabled this field. Note: Only these states allow multi-state FL, CA, ID, WV, KY |

|

||||||||

|

policy_limit |

This is the aggregate policy limit/liability amount associated with the policy. The requirement depends on State and Agency settings. There are about a dozen states that require this information when filing. For this reason, we recommend that you include the policy limit on every submission. If it isn't required by the state then this amount will be ignored. However, for a specific list, go here. |

Depends |

||||||||

|

property_limit |

Property Policy Limit The requirement depends on State and Agency settings. We recommend that you include the property policy limit on every submission. If it isn't required by the state then this amount will be ignored. Currently, this field only applies to PA.

|

Depends |

||||||||

|

transaction_line_of_business OR for multiple lines of business use: transaction_line_of_business_list

|

This is an InsCipher-specific import code. We recommend using the Generic Import codes, which can be found here: Generic Line of Business / Coverage Code List If you want to use state-specific codes, you can. These can be found here. For policies with a single LOB, enter the single import code. If there are multiple LOBs, then these would be added and separated by the pipe symbol “|”. The requirement depends on whether the state requires a line of business breakdown. As this varies by state, we recommend importing all transactions with multiple lines of businesses, where applicable. If the state only allows for a single LOB when reporting, our system would select the coverage that is associated with the greatest premium amount $. |

✓ |

||||||||

|

transaction_line_of_business_coverage |

The premium breakout (rounded to the nearest cent) without the dollar sign in the string. Broken-out premiums should be separated by a pipe symbol “|” and should be in the same order as the transaction_line_of_buisness_list. Whether there is a single line of business or multiple, the premium total should always equal the total added in the premium field above. |

✓ |

||||||||

|

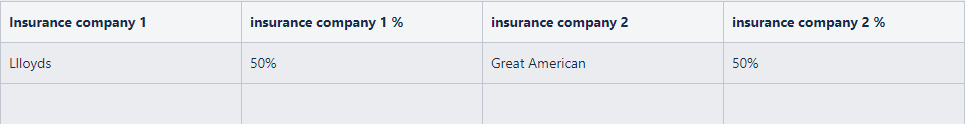

non_admitted_insurer_code OR for multiple insurance companies use: non_admitted_insurer_code_list |

This is the NAIC code associated with the insurer. Refer to the Insurance Company import list which can be downloaded here. For policies with multiple insurance companies, provide the NAIC insurer code list. Multiple values are separated by the pipe symbol “|”. For Lloyd's policies, use “AA-1122000”. Also, review syndicate_list and syndicate_list_coverage. This requirement depends on the state requires an insurance company breakdown. As this varies by state, we recommend importing all transactions with multiple insurance companies, where applicable. Example: 26883|35351 Must also provide details in non_admitted_insurer_code_coverage “non_admitted_insurer_code_list": "26883|35351",

|

✓ |

||||||||

|

non_admitted_insurer_code_coverage |

Applicable percentage breakdown. For single insurance companies, list "100" here. For multiple insurance companies, list the breakout. This value would be the percentage breakdown in 100 based values (without the “%” sign). List these in the same order as the non_admitted_insurer_code_list. Multiple values are separated by the pipe symbol “|”. The requirement depends on if the state requires an insurance company breakdown. As this varies by state, we recommend importing all transactions with multiple insurance companies, where applicable. If a state doesn't allow for multiple to be reported, then our system would select the carrier with the greatest percentage and report the amount with that carrier. Example: 60|40 |

✓ |

||||||||

|

syndicate_list |

Syndicate list breakdown for Lloyd's ONLY policies, for mult-carrier policies that have Lloyd's and non-Lloyd's carriers, please refer to the note below. Multiple syndicate codes should be separated by the pipe symbol “|”. The requirement depends on agency settings and if the state requires a syndicate list breakdown when filing. To simplify the import process, we recommend that you import all Lloyd's policies with a syndicate list breakdown (if possible). If the state does not require it, the breakdown will be ignored. Example: "non_admitted_insurer_code": "AA-1122000", "syndicate_list": "AA-1120131|AA-1120124", "syndicate_list_coverage": "60|40" Syndicate lists are required for multiple states. A full list can be found here: NOTE: Should you have Lloyd's and Non-Lloyd's carriers, then import transactions with multiple insurance company breakouts where the syndicates would be included in this breakout rather than as a separate syndicate field. |

Depends |

||||||||

|

syndicate_list_coverage |

Syndicate list breakdown should be listed as percentages without the percentage sign "%". Can be up to 5 decimal places. Example (50.55|49.45). Multiple values are separated by pipe the symbol “|”. Keep the percentages in the same order as the list above. The total amount for the array must equal up to 100. |

Depends |

||||||||

|

premium |

Policy premium If omitted 0 (zero) amount will be imported |

|

||||||||

|

agency_fee |

Policy / Broker / Agency Fee or other revenue-generating fee charged and retained by the brokerage to cover admin costs. If omitted 0 (zero) amount will be imported |

|

||||||||

|

inspection_fee |

Inspection / Audit / Underwriting Fee or fee retained or required to be charged by the carrier. If omitted 0 (zero) amount will be imported |

|

||||||||

|

collection_fee |

Collection Fee, which is a fee charged to the insured for the collection of the invoiced amount. Only applicable for KY. This is a non-taxable fee. If omitted or left null, this will import as "0" (zero). |

|

||||||||

|

sl_tax |

Surplus Lines Tax (name may vary slightly by state). The requirement depends on the Agency account setting if tax import is optional. If left null, 0 (zero) amount will be imported. |

|

||||||||

|

stamping_fee |

Stamping Fee (name may vary slightly as FSLO fee in Florida). The requirement depends on the Agency account setting if tax import is optional. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

|

||||||||

|

sl_service_charge |

Currently active only in the states of OR and MS. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

|

||||||||

|

municipal_fee |

Currently active only in KY. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

|

||||||||

|

fm_tax |

Fire Marshal Tax based on Line of Business. Active in IL, OR, MT, and SD and is based on premium amount. The requirement depends on the Agency account setting if tax import is optional. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

|

||||||||

|

empa_tax |

EMPA tax is active in the state of FL and is based on Line of Business. This value is also used (field is renamed on the UI) as the CT Healthy Home Assessment for property type coverages in CT. If applicable in the state and the amount is left null, then 0 (zero) amount will be imported. |

|

||||||||

|

total |

We recommend leaving this as null total amount = premium + all taxes + all policy fees. If omitted, the system will sum up and import the total automatically. |

|

||||||||

|

commission_received |

Is commission received? Currently only applies to NH. Yes = 1 If the commission is received, policy fees cannot be charged. If omitted, a 0 (zero) value will be imported. |

|

||||||||

|

mailing_insured_name |

Full insured name as it appears in policy documents |

✓ |

||||||||

|

mailing_address |

Insured mailing address |

✓ |

||||||||

|

mailing_address2 |

Insured mailing address line 2 (if applicable) |

|

||||||||

|

mailing_city |

Insured mailing city |

✓ |

||||||||

|

mailing_zip_code |

Insured mailing zip code |

✓ |

||||||||

|

mailing_state_code |

Insured mailing state. 2 letter state code abbreviation. Example: "CA" = California or "FL" = Florida |

✓ |

||||||||

|

insured_entity |

Insured entity types are used for states that may consider certain entity types tax exempt. If omitted, "commercial" will be used. Insured Entity Types are listed below:

Currently only applies to SC, NC, TN & FL. If known, this can be imported for every state and InsCipher will ignore the value in the states where it isn't applicable. |

Depends |

||||||||

|

insured_email |

Email address for the Insured |

Depends |

||||||||

|

insured_phone |

Phone Number for the Insured |

Depends |

||||||||

|

insured_county |

Mailing County |

Depends |

||||||||

|

physical_same_as_mailing |

If the Physical State is the same as the Mailing State, then set this value = 1 If the Physical State is NOT the same as the Mailing State, set this value = 0. IMPORTANT: If you make the physical state the same as the mailing state then you will need to make sure that both addresses are added with valid "States" codes or you will receive an import error. |

✓ |

||||||||

|

physical_address |

Physical address Required if Physical State is NOT the same as Mailing State. |

Depends |

||||||||

|

physical_address2 |

Physical address line 2 |

Depends |

||||||||

|

physical_city |

Physical City Required if Physical State is NOT the same as Mailing State. |

Depends |

||||||||

|

physical_zip_code |

Physical zip code Required if Physical State is NOT the same as Mailing State. |

Depends |

||||||||

|

physical_state_code |

Physical state. 2 letter state code Required if Physical State is NOT the same as Mailing State. |

Depends |

||||||||

|

agent_id |

Each Agency and Agent user is assigned an "Agent ID". This value associates the transaction to a specific user. If agent_id is omitted, the system automatically associates the transaction tot he parent Agency Admin user. Only applies if you have multiple agent users where you want to track the agent or account manager that is tied to the policy. Otherwise, leave blank. |

|

||||||||

|

retail_producer_name |

Retail Agency Name Required for filing in AK, CA, CT, DE, MO, MS, OR , PA and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_producer_license |

Retail Producer License Number Required for filing in AK, CA, CT, DE, MO, MS, OR, PA and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_agency_name |

Retail Agency Name Required for filing in AK, CA, CT, DE, MO, MS, OR, PA and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_agency_license |

Retail Agency License Number Required for filing in AK, CA, CT, DE, MO, MS, OR, PA and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_address |

Retail Producer’s Address Line 1 Required in DE, OR, MS, MO, and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_address2 |

Retail Producer’s Address Line 2 Required in DE, OR, MS, and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_city |

Retail Producer City Location Required in DE, OR, MS, and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_state |

Retail Producer State Location Required in DE, OR, MS, and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_zip |

Retail Producer Zip Code Location Required in DE, OR, MS, and WA if the business is written through a Retail Agent/Producer. |

Depends |

||||||||

|

retail_phone_number |

For future development |

Depends |

||||||||

|

retail_email_address |

For future development |

Depends |

||||||||

|

associated_producer |

License number of the associated producer, should this differ from the surplus lines license. Associated producer is meant to be used when the agency license is being used to file but the state asks for a particular broker within that agency to be listed. It is different than retail producer. For instance, in CA, associated producer is the “transactor” for the policy. Only applicable in PA, CA |

Depends |

||||||||

|

sop_name |

Service Of Process Name Currently, applies to AL and OK. Service of Process (aka service of suit) is a clause used in the event of a failure to pay amounts claimed under the policy, insurers agree to submit to any court of competent jurisdiction in the US to accept summonses and complaints. If asked for in the portal, including the Service of Process information that is included in the policy documents. |

Depends |

||||||||

|

sop_address |

Service Of Process Address Currently, applies to AL and OK. |

Depends |

||||||||

|

sop_address_2 |

Service Of Process Address 2(if applicable) Currently, applies to AL and OK. |

Depends |

||||||||

|

sop_city |

Service Of Process City Currently, applies to AL and OK. |

Depends |

||||||||

|

sop_state |

Service Of Process State. 2 letter state code Currently, applies to AL and OK. |

Depends |

||||||||

|

sop_zip |

Service Of Process Zip Code Currently, applies to AL and OK. |

Depends |

||||||||

|

dc_naic |

Declining Carrier NAIC Code Declining Carrier is an admitted insurance carrier that has declined the request for coverage. Multiple values are separated by pipe symbol “|”. Currently available in SC, TN, IN, NY, and CA - Necessary for SL-2 creation when not attaching SL2 Form Here is a mapping sheet that describes all of the declining carrier fields. |

Depends |

||||||||

|

dc_date_declined |

Declining Carrier Date Declined Currently available in NY, CA - Necessary for SL-2 creation when not attaching SL2 Form For future logic, if added, multiple values are separated by pipe symbol “|” and is required if there are multiple NAIC codes. If you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

|||||||||

| dc_declining_reason |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form Declining Carrier Declining Reason The reason why Admitted carriers declined coverage. Multiple values are separated by pipe symbol “|” and is required if there are multiple NAIC codes. The value imported would be the reason why the admitted carrier declined to write the business. This value imported is a state-specific reason and should be one of the options provided. If you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

|

||||||||

|

dc_representative_name |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form Declining Carrier Representative Name Multiple values are separated by pipe symbol “|” and are required if there are multiple NAIC codes. The value imported will be the representative name. IIf you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

|

||||||||

|

dc_representative_title |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form Declining Carrier Representative Title Multiple values are separated by pipe symbol “|” and are required if there are multiple NAIC codes. The value imported would be the representative name. If you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

|

||||||||

|

dc_representative_email |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form Declining Carrier Representative Email Multiple values are separated by pipe symbol “|” and are required if there are multiple NAIC codes. The value imported would be the representative name. If you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

|

||||||||

|

dc_representative_phone_number |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form Declining Carrier representative Phone Number Multiple values are separated by pipe symbol “|” and are required if there are multiple NAIC codes. The value imported would be the representative name. If you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

|

||||||||

|

dc_representative_website |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form allows for the use of a website instead of a representative name and contact information for completion of the SL2. Multiple values are separated by pipe symbol “|” and are required if there are multiple NAIC codes. The value imported would be the representative name. If you want to view the states that eventually will begin requiring this field, please see this mapping sheet and use the filter to show those fields that are inactive. |

|

||||||||

|

dc_who_received_the_declinations |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form (for CA only) This answer pulls in to Question 1 on the SL2 and allows for either the Surplus Lines Broker or the Retail Producer information to be used. |

|

||||||||

|

dc_other_person_in_office |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form (for CA only) This determines if the Surplus Lines Broker, Retail Producer, or someone else in their respective offices actually received the declinations, to correctly answer Question 7 on the SL2 |

|

||||||||

|

dc_who_performed_diligent_search |

For CA Only: Necessary for SL-2 creation when not attaching SL2 Form Accepted values are as follows:

If Account Written as = Direct Client (DC), then this value will be defaulted to "1" Surplus Lines Broker. |

|

||||||||

|

agent_notes |

Agent Notes Populates the Agent Notes section on the Filing Details page of a Filing Agent/Filing Agency Admin user. Include only if you want to add other information about the policy not captured in any of the other fields. |

|

||||||||

|

umr_number |

Lloyd's transaction number Required in NJ and MS if Lloyd's is a carrier on the policy. |

Depends |

||||||||

|

sla_transaction_number |

NJ Transaction Number (Format XXXXX-XX-XXXXX) Required in NJ |

Depends |

||||||||

|

wind_storm_exclusion |

Windstorm Exclusion Flag Flag on whether or not windstorm exclusion applies. Only applied to certain property coverages and only applies in TX and FL. TRUE = 1 |

Depends |

||||||||

|

wind_storm_eligible_for_pool |

Eligible For Windstorm Pool? Only applied to certain property coverages and only applies in FL. TRUE = 1 |

Depends |

||||||||

|

wind_storm_deduction |

Windstorm/Hurricane Deductible Amount of windstorm/hurricane deductible related to certain property coverages. Only applies in FL. If not applicable, leave blank. |

Depends |

||||||||

|

wind_storm_primary_amount |

Windstorm Primary Amount (Coverage A) Amount related to certain property coverages. Only applies in FL. If not applicable, leave blank. |

Depends |

||||||||

|

wind_storm_other_coverages_deductible |

All Other Perils Deductible Amount related to all other deductibles not mentioned in the other fields above. Only applies in FL. If not applicable, leave blank. |

Depends |

||||||||

|

lloyds_cover_holder_number |

According to LLoyd's, Cover Holder is a company or partnership authorized by a Managing Agent to enter into a contract or contracts of insurance to be underwritten by the members of a syndicate managed by it in accordance with the terms of a Binding Authority. For additional details please see here |

|

||||||||

|

lloyds_cover_holder_name |

According to LLoyd's, Cover Holder is a company or partnership authorized by a Managing Agent to enter into a contract or contracts of insurance to be underwritten by the members of a syndicate managed by it in accordance with the terms of a Binding Authority. For additional details please see here |

|

Additional Fields Applicable For Initial Data Migration

We recommend bringing in the current year's transactional data in order for the system to be able to account for what filings have been filed to date. To assist in this process, we have added the following fields to make the data imported contain the correct filing and paid dates.

Data migration will be done by your InsCipher Implementation Consultant. Please fill out the data migration sample file and email this to your consultant, rather than trying to import this file yourself. You will not need to do any data migration for the states of Idaho and Utah as these transactions are already in the InsCipher database.

|

Field Title |

Description |

|||

|

migrated |

Used to track InsCipher-filed transactions vs. client-filed transactions. All items listed as 4=FILED as the transaction_status should also be listed TRUE=1 in this column. TRUE = 1 |

|||

|

stamping_fee_invoice_id |

Stamping Fee Invoice ID If applicable, this value, if imported, relates to any state's stamping fee invoice number. Most clients choose to leave this blank during the data migration process. Note: this value cannot be forced for Utah/Idaho transactions. |

|||

|

stamping_fee_date_paid |

Stamping Fee Paid Date If applicable, this value, if imported, designates the data that a filing's stamping fee was paid to the state. Note: this value cannot be forced for Utah/Idaho transactions. |

|||

|

sl_tax_invoice_id |

SL Tax Invoice ID If applicable, this value, if imported, relates to any state's SL Tax invoice number. Most clients choose to leave this blank during the data migration process. Note: this value cannot be forced for Utah/Idaho transactions. |

|||

| sl_tax_paid_date |

SL Tax Paid Date If applicable, this value, if imported, designates the data that a filing's SL Tax was paid to the state. Note: this value cannot be forced for Utah/Idaho transactions. |

|||

| other_taxes_paid_date |

Other Fee Paid Date If applicable, this value can be used as a catch-all to track the date that any other state tax or fee was paid to the state. Note: this value cannot be forced for Utah/Idaho transactions. |

|||

| unique_id |

Unique ID This value is often reserved for certain state-specific ID codes, such as MO's Risk Number, IL's countersignature number, or NY's affidavit number. Import this value during your initial data migration for reference. |

|||

| transaction_status |

Transaction Status To be added by InsCipher prior to import. Value can be a number below representing the corresponding transaction status. Unless you are importing documents at the same time, unfiled transactions should be listed as 1=Saved

Note: this value cannot be forced for Utah/Idaho transactions. |

|||

| date_filed |

Date Filed If applicable, the date that the policy was filed with the state. If the Date Filed is added, the system will auto-default the transaction status to "Filed". Note: this value cannot be forced for Utah/Idaho transactions. |

|||

| license_number |

License Number Only will import if a valid license number exists for the same physical state. If left blank, the system will default to the "Default License". |

|||

|

filing_admin |

Filing Admin Assigning a filing ✓admin here will override the system's configuration that auto-assigns certain transactions to certain filers based on type, location, etc. |

|||

|

date_submitted |

Submitted Date The date that the transaction is submitted into InsCipher. If left blank, the system will default this to be today's date or the date the batch is imported into the InsCipher Portal. |

|||

|

transaction.filing_fee |

Filing Fee The contractual filing fee is to be charged by InsCipher for any transactions to be filed by InsCipher after the client go-live. |

|||

|

transaction.rush_filing_fee |

Rush Filing Fee The contractual rush filing fee is to be charged by InsCipher for any transactions that shall be filed by InsCipher after the client go-live that are already over 30 days beyond the transaction effective date. These filings are rushed to avoid late penalties applied by the states. |

Field Mapping Informational Packet

For information related to Lines of business import codes, Insurance company import codes, Description of Risk import codes, Filing Types, Tax Titles, and Document Requirements, refer to this mapping packet.

What About Attaching Documents?

We have a streamlined way of attaching documents. Please refer to this guide to learn more!

Change History

| DATE | DESCRIPTION OF CHANGE |

| 5/20/2024 | Added CT retail producer information |

| 2/1/2024 | Add associated producer description |

| 1/24/2024 | Update batch import file names |

| 12/11/2023 | Updated SOP to include OK |

| 9/22/2023 | Revamp of documentation based on new CSV import feature |

| 7/18/2023 | Added NY to the Declining Carrier field description |

| 6/20/2023 | Title adjustment only (removed old date) |

| 5/24/2023 | Added CA to declining carriers and retail producer |

| 5/19/2023 | Updated CSV for FS and Data Migration |

| 3/22/2023 | Updated Entity Type fields in article and CSV |

| 1/24/2023 | Update the sample file. Clarified several sections and removed n/a fields. |

| 1/17/2023 | Added file size limit to article |

| 12/21/2022 | Added clarification around the InsCipher-only Transaction_Status field for historical data imports. Updated the CSV import template accordingly. |

| 10/24/2022 | Added migration field clarification. Added note on formatting for currency. |

| 10/13/2022 | Removed export_list field |

| 10/4/2022 | Updates to wind storm fields and data migration fields added to data migration csv file |

| 8/26/2022 | New fields added: property_limit, layered_risk, broker_of_record, risk_retention_group, multiple sos and dc fields |

| 5/20/2022 | Added historical data migration section to description field list and to sample csv file. |

| 2/1/2022 | Added Change History Log. Added links to new FS Mapping Packet, UMR number, SLA transaction number, clarified language related to syndicate list. |